End the Tyranny of the IRS

We Need Tax Reform Now, or How Little Can We Live On?

American taxpayers should be up in arms and madder than hell over the taxes they are paying every year. Our taxes are at 50 percent of our annual income. We must work until about May 15 (tax freedom day) each year just to pay our taxes. Most families must have two members working to make ends meet: one to pay the taxes and the other to put bread on the table. The American tax system is undermining and destroying American family life. If we are to stop this erosion of our income and basic freedoms, we must fight for less government and for reform of the present income tax code.

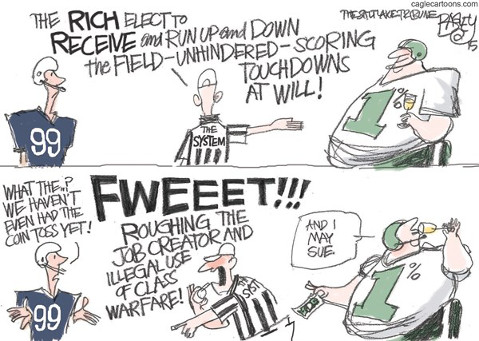

The United States and the individual states must reform their tax structures to make it more equitable for everyone. Today, 40 percent of the people pay 90 percent of the taxes. In addition, everyone wants to be excluded from paying any taxes by gaining special exemptions at the expense of other taxpayers. This is social redistribution of wealth, un-American, and unfair. The 99 percenters are freeloading on the one percenters! The one percenters provide all of the jobs for the freeloaders, why should they pay higher taxes?

Businesses should pay taxes based on their gross income. No exceptions, no write-offs, no depreciation or government support. This would end the present onerous tax code.

All income for nonprofits should be taxed. The Sierra Club, all religious organizations, Farm Bureau, NPR, ACORN, AARP, Democratic Party, Republican Party, unions, civil service, teachers unions, League of Women Voters, foundations, etc. are a few of the millions not presently paying taxes, and they would start paying their fair share of taxes on their gross incomes. Why should hundreds of billions of dollars collected by these groups be excluded from taxes at the expense of all taxpayers? No exceptions, no excuses, no exemptions for these either.

The fairest way to redo the tax system is by making the 16th Amendment to the Constitution, the income tax, a flat tax.

The flat tax must eliminate the present tax code, have one low rate, have no tax reporting, need a supermajority to increase, have no deductions and no exceptions, have no tax on private savings or capital gains, and have no credits for losses.

The IRS would become an audit agency of the companies and nonprofits submitting taxes. The IRS as we know it today would cease to exist.

Under this proposal, the rich pay more taxes than the poor, as it should be, but everyone pays. When everyone pays, everyone pays their fair share.

If these are not enough taxes to run the government, then reduce the size of the government to fit the available taxes. But when everyone pays a small amount, there will be more than enough to do our government business. American citizens are not here to pay for government but to take care of themselves and their children.

Don’t be fooled by other flat-tax proposals — they are too high at 17, 28, and 30 percent of income. And deductions and exemptions are still allowed. A flat tax of one to two percent is reasonable, and no exemptions allowed.

We need tax reform now to stop the destruction of our families and the continued growth of government! If we don’t get madder than hell now, we can be sure that we will be paying more taxes in the very near future. On how little income can we live? Forty percent, 30 percent … ? If we don’t do something to turn this monster around, that is where it is going — they will take it all!

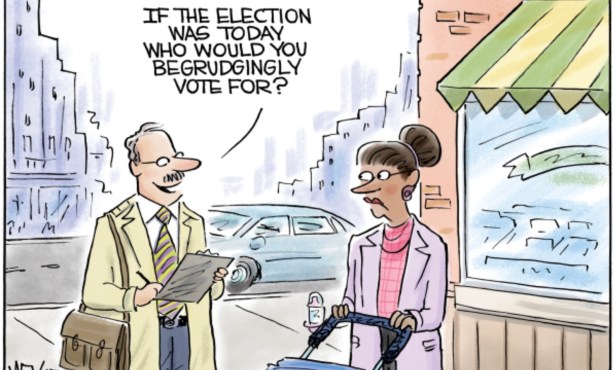

Do any of those candidates out there in election-land have the guts to make any of this happen if elected? I do not think so, but we must try or we will not have enough for bread.