Banks Too Big To Save

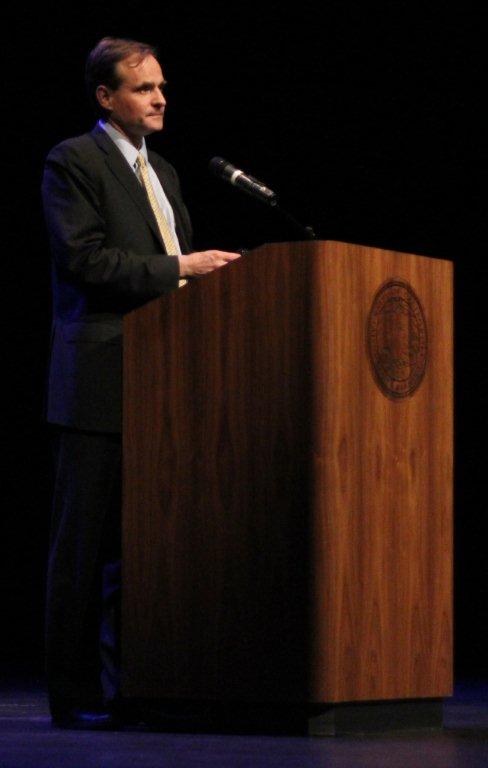

MIT Economics Professor Chats Up UCSB Audience

We’re Warned: Economist Simon Johnson warned a UCSB audience Tuesday night that if major banks are allowed grow “too big to save,” the U.S. would face an even worse financial meltdown.

But so far the federal government is refusing to listen to experts sounding the warning alarm that if mega-banks’ growth isn’t capped they will expand out of control into the global market, creating a disaster when they become “too big to save,” said Simon Johnson, economics professor at MIT and coauthor of the much-discussed 13 Bankers: The Wall Street Takeover and the Next Financial Meltdown.

Unless action isn’t taken to cap the banks, disaster looms, Johnson warned. “I don’t know when it will happen or how long it will take, but I hope we can take decisive action” to avert another, worse, meltdown, he said. “My concern is that next time you are asking for big trouble” unless there is crucial reform, he said.

Johnson, former top official of the International Monetary Fund, argued that powerful forces in the financial world have “captured” Congress and the White House, leading to killing restrictions on banking that had protected the nation until they were dismantled starting with the Reagan administration, and on into the 1980s and 1990s.

And that, Johnson said, led to reckless, unchecked behavior in the financial world, the meltdown, and the recession. The 13 bankers he refers to in the title gathered in the office of one of President Clinton’s top Treasury officials in 1998, Lawrence H. Summers.

The issue was a proposal by a Clinton agency to regulate derivatives, a financial method that was to cause so much havoc during the crisis. Summers opposed the regulation, as did Wall Street and economic heavyweights in the federal government, according to Johnson and coauthor James Kwak. “I have 13 bankers in my office and they say if you go forward with this you will cause the worst financial crisis since World War II,” Summers told Brooksley Born, then running the Commodity Futures Trading Commission.

The Clinton administration backed down. Derivatives remained unregulated and played a huge role in producing what was in fact the worst financial crisis since World War II, according to the authors.

“Recovery will fail unless we break the financial oligarchy that is blocking essential reform and if we are to prevent a true Depression, we’re running out of time,” Johnson wrote in an essay “The Quiet Coup,” in The Atlantic magazine in May 2009.

“I’m not a radical of the right or the left,” Johnson said Tuesday, although he has plenty of critics. What’s happened is that the financial world is operating under a “subsidy scheme,” Johnson told his UCSB audience. In good times, bankers rake in huge profits, but once the going gets tough, they now know that taxpayers’ money will come to their rescue and bail them out, he said.

When an economist comes to UCSB’s Campbell Hall on a chilly week night, one does not expect to find a full house, but virtually every seat was filled Tuesday.