School Pensions Swell

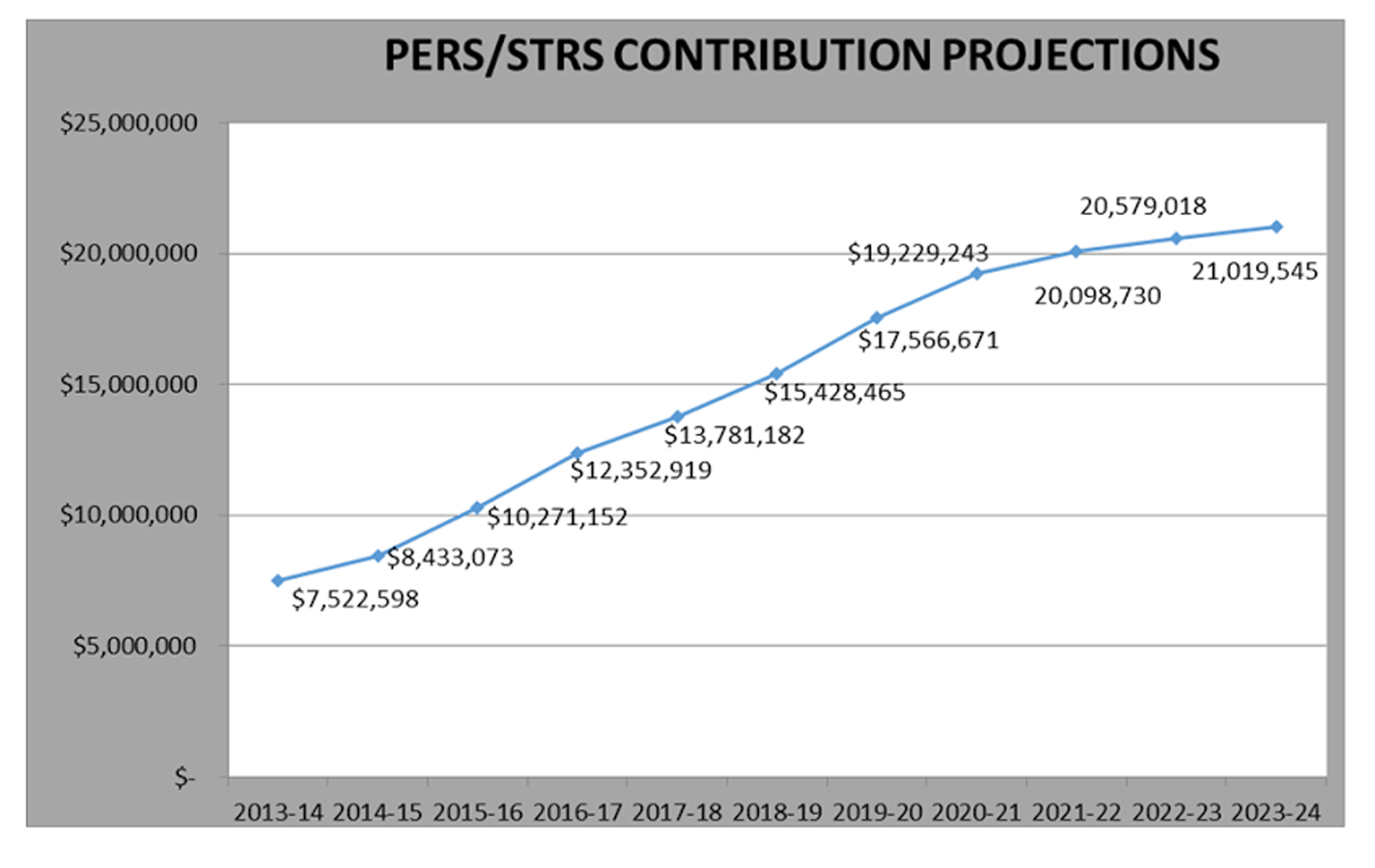

The steady climb of pension payouts (pictured) has been taking bigger and bigger chunks from Santa Barbara Unified School District’s budget as school districts statewide have been required to contribute more to their retiree’s benefit packages since state law was changed five years ago.

“It’s mind-boggling to me where we’re going,” said school board president Kate Parker earlier this month. “What it feels like is that we’re heading toward a system where we’re only paying for future retirement and not able to fund cost-of-living increases for people working right now.”

The district’s pension projections are combined payouts for hourly PERS (California Public Employees’ Retirement System) employees and STRS (California State Teachers’ Retirement System) certified staff, such as teachers and administrators with credentials and/or other certification. Both agencies manage multibillion-dollar pension funds and have anticipated poorer investment returns in the coming years.

This school year at Santa Barbara Unified, pension payouts have increased by more than 3.5 percent, while the district’s revenue has gone up by one percent. For the 2018-19 school year, pension obligations will go up nearly 5 percent, again outpacing revenues, which will increase by just under 2.5 percent.

“This is every district’s big problem throughout the state,” said Assistant Superintendent Meg Jetté. “I have no solution to this problem but to budget for it and plan for it. This is the stuff that keeps me up at night: How are we going to continually fund this?”