The Evolution of Chicago Free Market Economics

S.B. Author Lanny Ebenstein Breaks It Down in His Latest Book

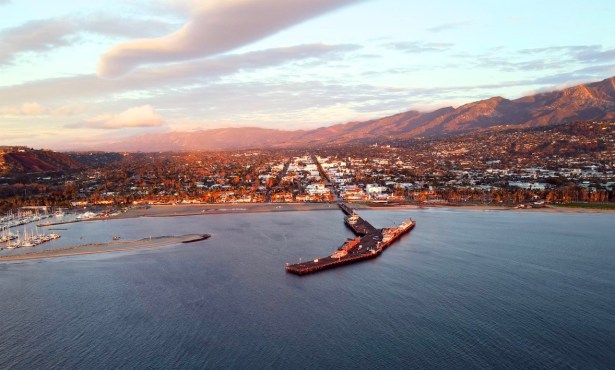

In the same way that a farmer knows the soil in his field, Lanny Ebenstein — UCSB lecturer and former candidate for mayor of Santa Barbara — knows the University of Chicago and its renowned School of Economics. With his latest work, Chicagonomics, which Bloomberg recently named as one of the top five books in economics, the prolific Ebenstein has now written five tomes with connections to Chicago, including biographies of two of its leading lights, Friedrich Hayek and Milton Friedman.

Endowed by John D. Rockefeller, the University of Chicago bears the distinction of establishing the first separate economics department in the United States. Chicago’s influence on economic theory and policy in the United States and beyond is unparalleled. Ebenstein traces the contributions of other notables, including Jacob Viner, Frank Knight, and Henry Simons, and makes clear that although Chicago is most frequently associated with Milton Friedman and libertarianism, the school is actually better understood as the home of classical liberalism.

I sat down with Ebenstein two days before Christmas, intrigued to learn more about how classical economic liberalism — which promotes free-market capitalism but with the recognition that government has a legitimate role to play — morphed into neoliberalism and the notion that any government involvement in the economy is an abomination and all taxation (of the wealthy in particular) evil.

Describing himself as an Eisenhower Republican, an extinct breed in this era of ideological extremism, Ebenstein pointed to the numbers: Economic growth in the United States was more robust and prosperity more widely distributed when nominal tax rates on the wealthy were high. Only a true ideologue still believes in the notion — in vogue now for nearly 40 years — that tax breaks for the wealthy produce prosperity for everyone.

To counter the concentration of individual wealth and power that he sees in contemporary society, Ebenstein advocates restoring the marginal federal income tax rate of 50 percent on the top one percent of earners. For those in the top 0.1 percent, the rate would be 70 percent.

Consistent with the thinkers from the Chicago School that he has studied and written about for years, Ebenstein views extreme income inequality as an undesirable social outcome. Indeed, Ebenstein writes, “The greatest problem facing the United States today is the substantial inequality, especially on the basis of age and family structure, that increasingly characterizes American society and the economy.” This has not always been so, historically speaking, and is one reason why Ebenstein also recommends proposals such as increasing the federal minimum wage to $12 an hour, reducing Social Security and Medicare taxes on working families, and reducing general sales taxes — which tend to be regressive — at state and local levels.

Like several of the economists and thinkers he writes about in Chicagonomics, Ebenstein holds to an abiding belief in utility, in policies that work for as many as possible, in scientific inquiry and knowledge, and in the venerable, but now, sadly, forgotten ideals of the Enlightenment, one of which is moderation. Extremism is to be avoided. If it were possible for our policymakers to have an honest, rational, adult debate about economic policy — and capitalism itself — Chicagonomics would be on the reading list.

I asked Ebenstein if he still harbors political aspirations. Laughing, he said that no, that’s behind him. Besides, he’s currently busy working on another book, this one about income inequality.