With our New Year’s celebrations well behind us, we take a look at how the local real estate market fared in 2022, compare it to past years, and consider what lies ahead for 2023.

First, let’s recall what happened in local real estate nearly three years ago. At the outset of the pandemic, sales initially slowed to a snail’s pace, but by mid-year of 2020, the housing market had picked up steam and properties were selling as quickly as they came on the market. The market’s galloping pace was spurred on by very low mortgage interest rates combined with an influx of people looking to work from home in a place they loved — Santa Barbara and its neighboring communities along the South Coast. This highly energized sales environment ran from July 2020 through all of 2021 and into the first few months of 2022.

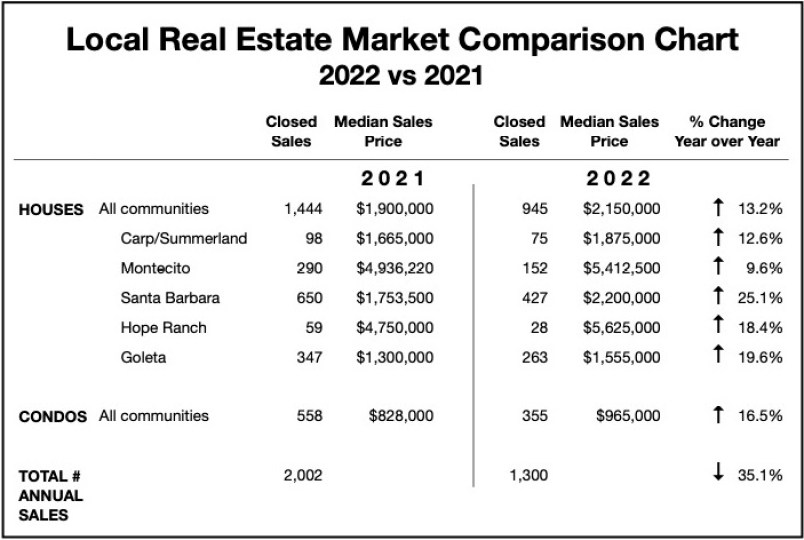

The median sales price for houses in 2022 was 13 percent higher than 2021: The median sales price for houses on the South Coast of Santa Barbara County ended up at $2,150,000 for the year; an all-time high. This was despite prices trending slightly lower the last half of the year. By May, as interest rates moved into the 5 percent range and higher, it had become clear that most new listings were not selling as quickly or with as many multiple offers as they had been.

Our local real estate market tends to have a pattern of fewer sales and softer prices in late summer and fall, and 2022 followed that pattern — somewhat accentuated due to higher interest rates and a very low number of properties for sale. Still, when all was said and done in 2022, our annual median sales price of $2,150,000 (for houses) was 13.2 percent higher than 2021’s median of $1,900,000.

Please refer to the chart comparing 2022 and 2021 sales information for houses in all major South Coast communities.

The median sales price for condos in 2022 was 16.5 percent higher than 2021: Bucking the often-seen trend of slightly lower prices toward the end of the year, condo prices continued to increase throughout 2022. The median sales price of South Coast condominiums ended at $965,000, which is 16.5 percent higher than 2021’s $828,000 median condo price. When the price of houses goes up substantially, condominium sales tend to pick up because they are the affordable option for entry-level buyers. This was a major factor in the continued high demand for condos throughout the year, even with higher interest rates. On the chart, condominium data are combined for the entire South Coast, not separated by community.

The number of sold units dropped dramatically in 2022 compared to 2021: One notable aspect of the 2022 market was markedly fewer sales for the year compared to the two previous years, which were exceptionally robust. A combined total of 1,300 houses and condos sold in 2022 compared to 2,002 units in 2021 — a drop of 35 percent year over year.

Sign up for Indy Today to receive fresh news from Independent.com, in your inbox, every morning.

Low housing inventory was a problem in 2022, and still is! One big reason that prices held up so well in 2022 is that relatively few houses were available for sale; buyers were often competing for homes, and prices went up. To put this in perspective, last year, there were about 30 percent fewer listings compared to the average of the previous four years, all of which had a similar number of properties for sale.

Mortgage interest rates hit 7 percent but have improved since the highs of October/November: Rates were a huge story in 2022 and had a notable effect on buyers’ ability to purchase, particularly during the last half of the year. All-cash sales can account for 20 percent to 50 percent of the sales, depending on the neighborhood and market conditions, and therefore the rates don’t affect every purchase. So, while we don’t have specific data on how much the interest rates affected our market overall, probably every Realtor worked with buyers who were very affected by the higher rates. Starting out last January at about 3.25 percent, rates for 30-year fixed conforming loans moved to the 5.75 percent range in mid-June, then continued climbing up to the 7 percent mark in October and early November. Then they went down, reaching 6.25 percent by the end of December. Fun fact: Rates went up faster in 2022 than any year since economists began tracking them 52 years ago.

What’s in store for 2023? After so many changes in the real estate market last year, it’s hard to know exactly what to expect. What we don’t expect, however, is a super hot market, and neither do we expect a crash: that would require a glut of homes to come on the market. The keys to how the real estate market will behave in 2023 are housing inventory and mortgage interest rates. In other words, the basics of market economics — supply and demand. With a low supply of homes, demand increases and prices stay strong; with high interest rates, demand slows. It’s a dance.

Many economists, including those at the California Association of Realtors, predict that by theend of 2023, we will find that median prices and the number of sold properties end up somewhat lower than last year. But statewide predictions rarely reflect our area exactly. These trends seem plausible given how the market behaved last fall, but the market has picked up again! There just aren’t enough properties for sale to satisfy the buyer demand, and we are actually seeing an increase in multiple offers. It wouldn’t be too surprising for the median priceof homes to increase in the near future and cool off later in the year, especially if housing inventory builds up.

California economist Steven Thomas (reportsonhousing.com) recently confirmed that so far this year, people are buying up what comes on the market in Southern California, keeping the inventory of available homes for sale at low levels. He also noted that if buyers are waiting for lower mortgage rates before making a purchase, they might find themselves competing for their dream home with other buyers who were also waiting out the rate. What if you find that special house when rates are higher than you’d like? He suggests you consider buying the property and refinancing your loan when the rate goes down. As the phrase goes: “Date the rate, marry the home!”

For the best information and counseling on buying and selling property this year, contact your Realtor of choice for up-to-the-minute price and inventory conditions for specific neighborhood information. It’s never too early to get your agent involved with an upcoming sale or purchase.

Data for this article was compiled for January through December 2022 by the Santa Barbara Multiple Listing Service and analyzed by members of the S.B. Assoc. of Realtors’ Statistical Review Committee. Writer Sue Irwin is a Realtor with Berkshire Hathaway HomeServices who is celebrating her 20th year in real estate this year. Contact her at (805) 705-6973 or sueirwinrealtor@gmail.com.

Support the Santa Barbara Independent through a long-term or a single contribution.

You must be logged in to post a comment.