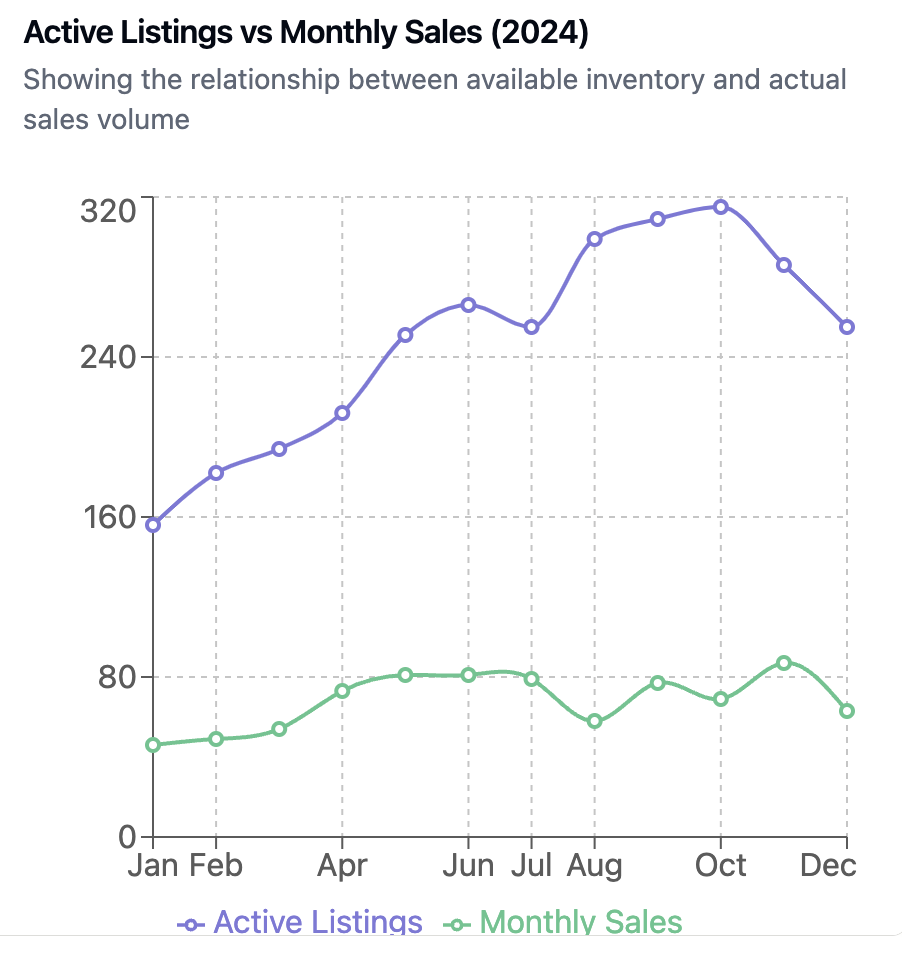

Our Santa Barbara real estate market produced a steady pace of sales and balanced pricing last year. While we were happy to see 16 percent more homes for sale in 2024, that was not enough to quell buyer demand. New listings in 2024 increased to 1,169 from 1,009 homes listed in 2023. With nearly 100 homes listed for sale each month, on average, 70 homes sold each month with strongest sales in the summer months.

With interest rates at approximately double what they were two years ago many homeowners feel effectively locked in to their low rate loans. Those homeowners who might like to change homes face new loans with nearly 7 percent interest rates. When sellers feel stuck and supply is low, demand drives prices up.

Current Pace of Sales

Market velocity is defined by dividing the number of active listings by the number of properties in escrow. As a general rule, anything less than three months of inventory is indicative of a sellers’ market. Market-wide, there is just about two months of inventory: Carpinteria’s pace is extremely fast, with just 1.4 months of inventory. Santa Barbara follows at 1.9 months, and Goleta, also still firmly in seller’s market territory, has 2.4 months of inventory.

Price Performance

The median sales price of a single-family home on the South Coast Santa Barbara market slow-waltzed its way up from 2023’s median of $2,100,000 to end the year at $2,150,000, a modest gain of 2.4 percent. Perhaps higher interest rates do have a silver lining for buyers.

Montecito’s housing market has cooled in the last few years, with annual home sales dropping to less than half the volume seen during the COVID-fueled buying frenzy of 2020-2021 when nearly 300 homes a year sold. Last year, 130 homes were sold in Montecito.

Though 2024 brought hopes of significant rate cuts, the mere half-point reduction has done little to entice sellers back. While today’s mortgage rates of 6.5 percent to 7 percent align with historical norms, they stand in stark contrast to the unprecedented era of low rates from 2008-2022. That 14-year stretch of affordable mortgages shaped an entire generation of homeowners. These homeowners, with their favorable low-rate mortgages, have been reluctant to sell unless compelled by major life events.

Areas of Stellar Performance

But lest these averages lead you to believe not much is happening, there is a bit of a tale of two cities here. Montecito’s luxury property market maintained its elite pricing and then some, closing 2024 with an impressive median sales price up from $5,460,000 in 2023 to $5,687,500.

Six Years of Growth

Some areas have doubled their median sales price in just six years! And looking at the relative changes across four markets reveals some fascinating patterns.

In Montecito and Hope Ranch, there were robust gains in six years, although smaller data sets can yield less reliable short-term statistics, it appears that Hope Ranch has seen a doubling of their median sales price, from three million to six million dollars.

Montecito has seen their housing prices grow by 84.4 percent (1.84x multiple) in six years. Santa Barbara’s 43.8 percent growth (1.44x multiple) looks downright reasonable since 2019. Santa Ynez Valley notes a fantastic 90.5 percent growth (1.90x multiple) rate in sales prices since 2019.

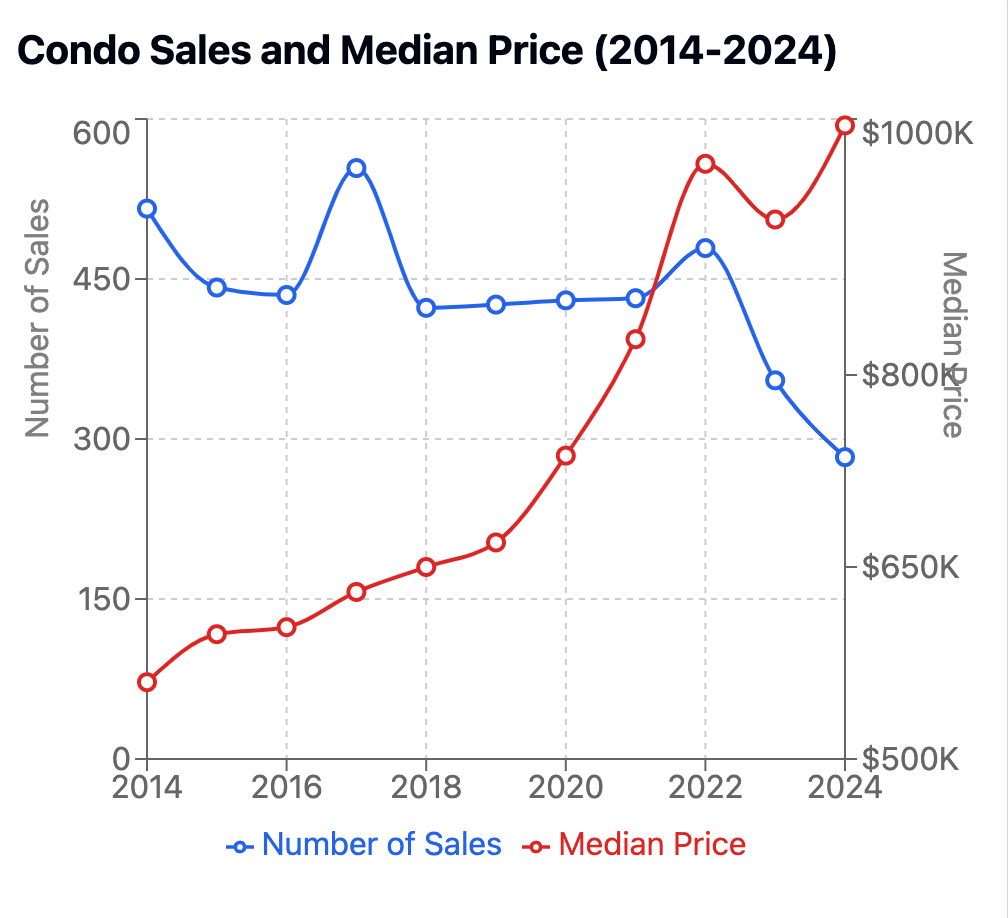

Condo Performance

No one doubts that we need more housing, but condos are not being built at the rate of ADUs. What is the result of a limited supply? The chart shows how condos fared in price appreciation and the number of sales closed each year. As supply became limited, prices went up to end the year with a median sales price of $995,000. That’s a total price growth of 77 percent over 10 years (from $560,000 to $995,000.)

The year ended with just 36 condos for sale from Goleta to Carpinteria — just two months of inventory.

The Path Ahead

What’s a well-priced home worth in today’s market? Let’s look at the numbers: Homes that found their buyers in 2024 spent about 55 days on the market, and sellers walked away with 96 percent of their asking price. That’s a strong market.

The California Association of Realtors forecast that the median prices and the number of sold properties will increase modestly in 2025. But statewide predictions made last month did not include the tragic loss in the Los Angeles area, combined with an already high need for housing, a possible labor shortage and rising inflation. Those factors may make for a volatile and expensive market.

Determining what to buy or when to sell is a complex composition of lifestyle, neighborhood, future equity, and finance. After all, you’re not just buying a structure; you’re falling in love with a future. There just aren’t enough properties for sale to satisfy the buyer demand for our special town, and no reason to believe that will change when rates come down. The old wisdom rings true now more than ever: “Date the rate, marry the home!” Interest rates are like seasons; they change. But finding that perfect slice of Santa Barbara paradise? That’s a once-in-a-lifetime dream, well worth pursuing.

For the best information and counseling on buying and selling property this year, contact your Realtor of choice for up-to-the-minute price and inventory conditions for specific neighborhood information. It’s never too early to get your agent involved with an upcoming sale or purchase.

Data for this article was compiled for January through December 2024 by the Santa Barbara Multiple Listing Service and analyzed by members of the S.B. Association of Realtors’ Statistical Review Committee.

When she’s not crafting real estate magic across the South Coast, writer Paige Kaye leads her namesake brokerage with two decades of market savvy and a keen eye for market trends. She’ll answer the phone at (805) 964-1410 or contact her at paigekayebroker@gmail.com. DRE #01468942

You must be logged in to post a comment.