Blaming Wet Sidewalks for the Rain

The Real Reasons We Have Inflation

Despite Joe Biden’s best efforts, and that of his White House communications department which is outsourced to CNN, the strategy to make Vladimir Putin public enemy #1 by blaming him for inflation has failed. The American people aren’t buying it. They only buy half of it. They buy the inflation part, but they aren’t buying the Putin caused it part. They blame Putin for invading Ukraine, but they blame Joe for why they are paying more for everything.

I thought I overheard a lady in front of me at the grocery store the other day saying “I remember when it used to only be $1 to help feed the hungry. Now it’s $5. It’s obviously inflation.” I smiled at her and said, “I remember when it was only a penny for your thoughts. Now it’s 5 cents.”

Allow me to do my Joe Biden impression: “Look folks, this is no joke, inflation isn’t the only reason prices rise. And rising prices aren’t only caused by inflation. Prices rise due to a whole variety of causes, and inflation has little to do with why prices are rising at the rate they are rising today.”

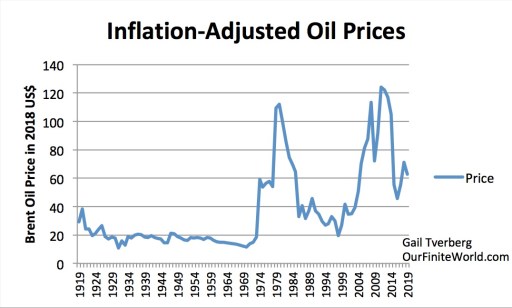

But before I go on, let me state the obvious. We have inflation. All one must do to understand this is check the price of gold and watch its price move against the value of the dollar. If you want to really earn some extra credit, track the price of gold against the value of the dollar and the global price of oil, and you’ll understand how the dollar’s value is linked to both gold and oil.

When the dollar is strong, or said another way, when the dollar is weak, the higher the price of gold, and the higher the price of oil. When the value of the dollar falls, gold rises, and so does oil. Those two metrics are all the evidence you need to know we are experiencing an inflationary monetary policy in America. But since a picture is worth a thousand words, see for yourself. Today, gold relative to the dollar is falling as the Treasury tries desperately to shore up the dollar.

Inflation is real, but it isn’t when Netflix increases the price for your service. Inflation is real, but it isn’t the real explanation for the rise in the price of bacon. Inflation is the devaluation of the currency. What we experienced in the 1970s, when Nixon took the country off the “gold standard” by abandoning the Bretton Woods Agreement, when the dollar essentially became a fiat currency, with its value no longer being fixed to an ounce of gold, or any other fixed store of value. That was inflation. The dollar was allowed to float against other foreign currencies, and thus commodities began to rise against the dollar, including oil, but also and especially gold. That, folks, was inflation. The same is true now. But again, see for yourself.

And because higher oil prices beget higher gas prices, this is really at the core of the problem Americans are facing in their daily lives. Higher fuel costs beget higher costs throughout the economy leading to an overall rise in the general price level as measured by the consumer price index (CPI).

Although it must be said the CPI is a notoriously unreliable measure of the rise in prices in the broader economy.

To be clear, I’m not blaming inflation for the higher prices for most of the consumer goods we buy. I’m blaming it on higher transportation costs, although that is only a part of it, and as I’ll get to in a minute, a relatively small part. Today’s higher transportation costs, relative to 18 months ago, without question, are a result of higher fuels costs, and sure, today’s higher fuel costs are due to the recent spike in the global price of oil. But that isn’t a new phenomenon. Global oil prices have been on the rise since President Clinton left the White House. See the inflation-adjusted oil price chart. Notice only Reagan and Clinton enjoyed low global oil prices. They also had strong dollars.

As John Tamny, the editor of RealClearPolitics and the only economist I know of who is writing about this, likes to put it, blaming inflation for the rise in the general price level is the monetary policy equivalent of a meteorologist blaming wet sidewalks for the rain.

Wet sidewalks don’t cause rain any more than inflation causes prices at your local grocery store to spike. The devaluation of our currency is why the things we buy today — like a home, a car, clothes, bread, milk — are more expensive today than they were 30 years ago.

However, inflation isn’t why those things are more expensive than they were a month ago, a year ago, or 18 months ago. The reason why prices are higher for so many of the items we buy today is that in March of 2020, politicians panicked, to borrow another one of Tamny’s words. Tamny wrote a book called When Politicians Panicked. And he writes about — and at the time I, too, was talking about this — the fact that politicians including at the local level, were only listening to public health bureaucrats instead of economists and made the spectacularly stupid decision to shut down the economy.

You can’t shut down an economy that relies on the invisible hand of the market that involves billions of individuals making billions of decisions every minute of every hour of every day across millions of miles simultaneously across hundreds of industries and sectors. And then a year later turn it back on like it’s a light switch and expect it to return to its same level of flawless efficiency and expect it to produce at the same level of efficiency and with the same low prices. It’s staggeringly naïve to even contemplate such a remarkably ignorant belief or assumption. Especially people who are normally conservative and hold views that are predisposed to being skeptical of decisions by politicians and bureaucrats.

So, just to be clear, yes Virginia, prices are higher than they should be due to the steady devaluation of the dollar over a very long time. But this began over 50 years ago. Not when Biden was elected.

You must be logged in to post a comment.