Liberal vs. Libertarian: Is the Market Self-Correcting?

Sam Kornell Interviews Lanny Ebenstein

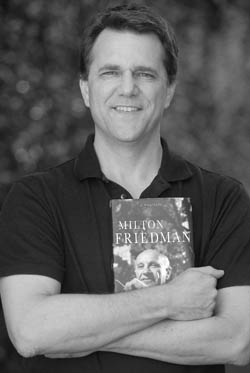

A basic question has been hanging over the ongoing economic meltdown on Wall Street: Is the market self-correcting–as conservative economists, bankers, and politicians from Milton Friedman on have aggressively claimed–or does it need to be regulated by the government? On Thursday, September 18, I put that question to Lanny Ebenstein, a former Santa Barbara School Board member and mayoral candidate, currently a visiting professor of economics at UCSB, and Santa Barbara’s most prominent Libertarian. Last year Ebenstein published an admiring, well-received biography of Milton Friedman, the most famous and influential economic Libertarian of the 20th century.

Kornell: Since Bear Stearns went under, the U.S. Treasury has taken on more than a hundred billion dollars in bad debt bailing out Wall Street. [Since this interview, estimates of the amount of bad debt Treasury has taken on have risen to hundreds of billions of dollars.] It also took on $5 trillion in liability from Fannie and Freddie. All of these bailouts are necessary because of terrible financial decisions by bankers on Wall Street, decisions that were made possible by a near total vacuum of government regulation. How should American taxpayers look at this, in light of the fact that they’re picking up the bill?

Ebenstein: I’m not sure if that’s correct. The sub-prime mortgage situation, which was really the cause of all of these problems, started out as a desire to extend the benefits of homeownership to a larger percentage of the American public-

Kornell: That’s not true. It was because bankers on Wall Street wanted to get rich using complex, predatory methods of selling mortgages to people who had no business buying them, and they knew they could do it because there was no government regulation or oversight.

Ebenstein: Well, right now the underlying question is whether, ultimately, the investments were good investments or bad investments, and over time I think they’ll prove to be good investments. I think interests will come down and values will stabilize.

Kornell: How can you say that? This is bad paper-hundreds of billions of dollars of investments have been lost. I mean, the damage is spreading into money markets, which are supposed to be inviolable. How can you say these are good investments?

Ebenstein: Time will tell. If property values continue to decline you’re absolutely right, all of this paper will be worthless and the taxpayer will be left holding the bag. On the other hand, if property values stabilize, I think there will be an entirely different scenario. The financial superstructure is reorganizing right now, not the real economic basis of the society.

Kornell: Since Ronald Reagan we’ve been constantly told that the market is self-correcting, and that interference in the economy in the form of regulation is bad. And we’ve been told that these brilliant guys on Wall Street know what they’re doing, and all of these incredibly complex financial instruments they use are efficient and ultimately result in broadly shared prosperity. And I think there are a lot of Americans right now who feel like they got sold a bill of goods. All of this stuff-the mortgage-backed securities, the credit default swaps, the short selling, the naked short selling-happened with virtually no government regulation.

Ebenstein: Well, the Republican line on this issue, and I’m not necessarily endorsing it but I’ll repeat it, is that the Bush administration sought regulatory reform in some of these areas, but Democratic Senators like Chris Dodd vehemently opposed it. So it’s not-

Kornell: That’s absurd. They didn’t want regulatory reform, they wanted no regulation. And they got it. They got it in 2000 when Phil Gramm back-doored the Commodities and Futures Modernization Act in an omnibus spending bill, which essentially stripped government oversight from all of these areas. And the Bush administration ran with it, and now we hear that under a McCain administration, Gramm may be the Secretary of the Treasury.

Ebenstein: As I said, that’s the Republican line. Whether it’s accurate or not is another question. The more general point is this: The idea of the market is that government has to establish the rules; it has to be the umpire. So the idea that we don’t have the optimal rules and regulations is completely consistent with a free market position.

Kornell: In response to all of this, John McCain has said he’s going to clean up all of the corruption and greed on Wall Street. Obviously, greed on Wall Street is bad and it’d better if it didn’t happen. But what’s McCain talking about? These bankers have an obligation to make money for their shareholders, and the obligation of the government is to regulate them and make sure they do it in a fair, intelligent way. The issue is regulation, not greed, and McCain has been consistently for deregulation of the financial markets for as long as he’s been in office.

Ebenstein: Well, I’m not sure if it’s the duty of the government to regulate. I think it’s the duty of the government to establish rules within which business and individuals can operate. I think the problem is when the government moves away from establishing a framework of rules within which people can operate, and starts telling people individually what they can do in a particular circumstance.

Kornell: I’m not sure I understand the distinction, but either way it seems like the problem right now is that there was no framework. There was no framework. There was no oversight. There was no regulation.

Ebenstein: Well, I agree. In some of those areas there should be new regulation. And I think whoever’s elected president will see that there’s new regulation in those areas.

Kornell:And who’s more likely to accomplish that? The Democratic candidate or the Republican candidate?

Ebenstein: In general, I’m not sure if either party has been more or less inclined to enact tax and regulatory policies that favor one interest over another. I don’t look at this as a Republican-Democrat issue.

Kornell: But at least since Reagan, an explicit selling point of the Republican Party philosophy has been that regulation is bad and markets self-correct. I mean, that’s the Republican platform, is it not?

Ebenstein: Look, in our system, special interests have been able achieve particular benefits that are not in the common interest, and that’s because they lobby politicians in both parties, and the issues are very technical and complex, and people’s ability to follow them is limited except in a crisis, and then, once the crisis passes, they presume the system is working okay, and it’s business as usual again. I do hope that out of the dislocations that have occurred, there will be some regulatory reform. And I think we’ll ride this out.