On Solar and Solyndra

Installations Are Up, Costs Are Down, and We Are Closing in on the Holy Grail of Grid Parity

Reports of the death of the solar industry are greatly exaggerated. Yes, there have been some high-profile bankruptcies of U.S. solar companies – Solyndra, Evergreen, Spectrawatt – in 2011. But the solar industry as a whole is on a boom that is only going to increase in coming years. We are in the elbow of an exponential solar growth curve that is going to transform how we produce and use energy.

This is great news for all energy users and the planet.

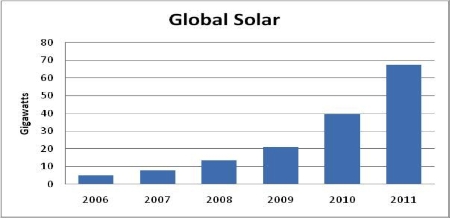

Solar has reached scale as a global industry, growing from its first gigawatt of annual installations in 2005 (enough to provide power for about 200,000 California homes) to over 28 gigawatts in 2011 (enough for almost 6 million homes), according to Bloomberg New Energy Finance projections. Cumulative installations will reach about 40 gigawatts by the end of 2011 – power for 8 million homes.

Global solar power has grown an average of 68 percent each year over the last five years. This is a doubling literally every 1.3 years. So today’s 40 gigawatts of capacity becomes, under the same growth rate, an astronomical 1.3 million gigawatts by 2030.

Obviously, the recent rate of growth won’t continue because, among other reasons, this is far more power than we need for the entire globe! But even if solar power’s rate of growth drops in half to 35 percent over the next two decades, this produces a doubling every 2.3 years and we get 16,000 gigawatts (16 terawatts) by 2030 – almost as much as the entire world will need by then.

Is this realistic? This rate of growth will surely slow, for a variety of reason. Still, the number of projects on the waiting list for connection with the utility grid in California, an indicative microcosm of the global market, suggests that we will see very robust growth for years to come. That interconnection queue has far more than 50 gigawatts of solar projects waiting for interconnection (studies take some time and then upgrades must be built so the interconnection process can take many years sometimes). Many of these projects won’t be built, for various reasons, but even if one third to one half of them get built we will see a dramatic increase in solar power in our state.

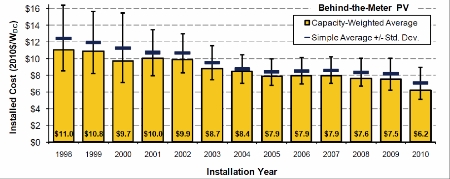

What about cost? A large part of why solar growth has been so strong in recent years is because prices have been declining dramatically in recent years. Lawrence Berkeley National Lab (LBNL) issues a solar-power market report on the U.S. market each year. Their latest report, released this month, shows that behind-the-meter solar project prices dropped almost by half from 1998 to 2010. The first half of 2011 saw yet another 11% drop in averages in California, the biggest market in the U.S., from $6.40 per watt to $5.70 per watt.

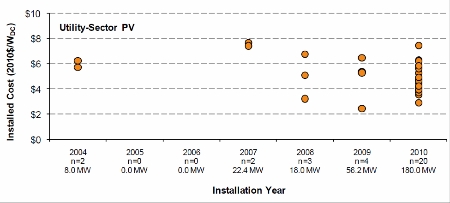

Behind-the-meter solar is important but is dwarfed globally by utility-scale solar, and this emphasis on utility-scale solar will probably increase in coming years due to the dramatic price declines we’ve seen for solar. The public data for utility-scale solar is much less comprehensive, but prices are far lower for this segment due to economies of scale. Utility-scale solar projects can be from one megawatt to many hundreds of megawatts, compared to a couple of kilowatts up to one or two megawatts for behind-the-meter projects. Average U.S. installed costs for utility-scale solar in 2010 were between $3.80 per watt and $4.40 per watt, according to the National Renewable Energy Laboratory. Lawrence Berkeley National Lab data show slightly higher costs in its limited data set. I have reliable anecdotal data that suggest pricing for new projects to be completed in 2012 will be below $3 per watt, reflecting panel prices as low as $1.15 per watt! Time will tell if these last figures are accurate but the established declining cost trends over the last ten years suggest they are.

What about grid parity—the point at which photovoltaic energy is cost-competitive with other coal, nuclear, hydroelectric, or other energy sources. With all of these cost declines are we there yet? It depends.

Grid parity depends, of course, on what grid is being considered. With federal tax benefits for solar (which apply also to nuclear, for those who think commercial solar gets a leg up), utility-scale solar projects may be at grid parity now in California. I write “may be” because we have public data from very few completed utility-scale projects in California, so we can’t yet compare price forecasts to actual prices. Such data will be available in the coming year or so for a number of new projects.

Many utility-scale solar contracts have been approved by the California Public Utilities Commission at prices below grid parity (the “Market Price Referent”), when the federal tax benefits are included, but these projects haven’t been built yet. Again, we’ll have to wait and see if these contracts result in real projects.

The trend is very clear, however: we are, if not already there, well on our way to solar grid parity in California and other areas of the country that have high electricity rates. While tax benefits are a substantial factor in the viability of solar projects today, this will change quickly as prices diminish further. And this trend will expand geographically very quickly because solar production is ramping up so quickly around the world – with the declining prices I’ve mentioned as the main benefit. My feeling is that by 2015-2020 solar projects in most western states, Hawaii, and New England, will be at grid parity even without any subsidies.

The Solyndra debacle is unfortunate and I look forward to learning more about what went wrong, including whether there was any wrongdoing by Solyndra or the White House. But the Solyndra story is a small part of the global solar story, which is one of the few extremely encouraging trends in the U.S. and world today. Massive solar growth will grow domestic jobs, increase energy independence, reduce greenhouse gas emissions, and, as we transition to electricity as a fuel for transportation, allow for the decarbonization of our transportation sector also.

Tam Hunt is owner of Community Renewable Solutions LLC, a consulting and project development company focused on community-scale renewable energy. He also teaches climate change law and policy at the Bren School of Environmental Science & Management at UCSB.