Flowers, or a Punch in the Nose?

I Love It, I Love It Not, I Love It ...

Dear New Health Care Law,

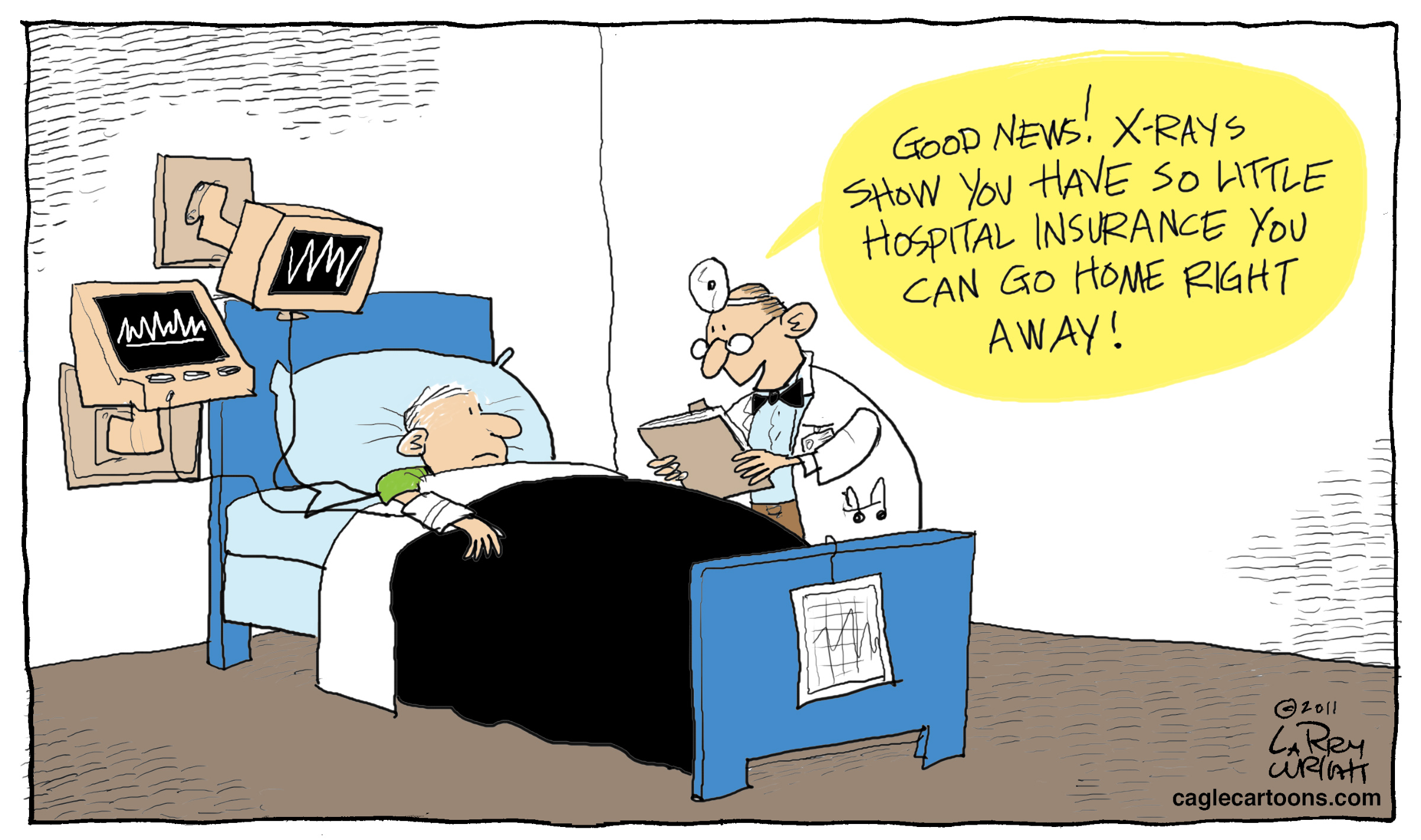

With many of your main provisions on the horizon, I don’t know whether to hug you or punch you in the nose. As a career health insurance agent, it’s easy for me to see some of your best attributes. We have struggled with insuring people with pre-existing conditions for years and for solving this I am most grateful. Many people have had to go without coverage or have been stuck in expensive programs and as of January, 2014, this will, thankfully, change. Premiums will be based on age and adjusted gross income and not on health status. All legal residents can buy coverage on a sort of sliding scale, lower income individuals will have access to free or low cost insurance, and higher incomes can buy great plans but at a cost.

I know those making less than 138% of the poverty level (roughly, $15,000 single/$31,000 family of 4) will be big fans of the expansion and improvement of Medi-cal. Currently, Medi-cal requires a much lower income to qualify and is difficult to get if you are childless.

Everyone below 400% of the poverty level ($44,680 single/$92,200 family of 4) will have subsidized premium in the new individual exchanges to keep the cost of health insurance to 9.5% of income or below. Those above this threshold are probably looking at hefty rate increases. Indeed, some actuarial studies predict a 32% jump due to mandated benefits and access. My own family’s estimate on the coveredca.com site is $1,436 per month. This is a 100% increase over our current premium, and this is why I think it would feel very good to punch you, but these are estimates so I am still hopeful.

Young people may see a premium jump as their rates get closer to that of older members, since a 64-year-old’s premium cannot exceed three times that of a 19-year-old. Conversely, older people may have some premium relief.

Despite the controversy surrounding it, I also appreciate the mandate. It’s the only way to assure that we have enough healthy people to balance the sick. We all never know when we are going to need insurance, so it is important and fair that everyone is covered. However, I am worried that the 2014 penalty of 1% of income ($95 minimum) is so small next year it may not inspire enough healthy buyers.

Small businesses under 25 employees which pay an average wage under $50,000, may be able to take advantage of a tax credit to offset premiums, when purchasing through the small business exchange (SHOP). Many businesses will experience rate increases due to the increase of mandated benefits and taxes on premiums, and the lowering of plan deductibles. I am concerned about employees’ dependents, as they may be locked out of individual plan subsidies if the employer is providing “affordable” coverage, even if the employer is insuring only the employee. This is a frustrating aspect of this law since dependent family members of small businesses have always been under insured.

For everyone who buys through the Exchange, the process of becoming insured should be easier on several levels: there will be no health questions, and insurers will offer standardized plans from Platinum, Gold, Silver, and Bronze. These plans are slated to cover 90%, 80%, 70%, and 60% of medical costs, respectively. No matter which plan you get, your out-of-pocket spending for the year is capped at $6,250 (if you have an individual plan) or $12,500 (if you have a family plan).

In October this year a massive enrollment season begins as the individual and a limited version of the small business exchanges come online, and shoppers will see if they want to bring this law flowers or put it out on the curb. In the meantime, for individual insurance buyers, consider lowering your adjusted gross income so premiums will be correspondingly lower within the exchange; this can be done by contributing to retirement accounts or health savings accounts if available.

California is allowing brokers to continue to assist individuals and businesses with their medical insurance. Anyone working with an agent should try to remember that if there’s any punching to be done, healthcare reform is the proper recipient. Of course, most agents will continue to accept hugs from happy clients.

Signed, Diana