How Thinking Affects Investing

Behavioral Economics, Part 1 of 4

As investors, our goal is to make money. To do so, we buy assets that we hope will, one day, sell for more than we paid for them. Doing this with stocks or options is not easy, because the market in which we work is both complicated and unforgiving.

The best investment decisions happen when we acquire pertinent information, evaluate it logically, and then act rationally. Over the years, however, I have come to the conclusion that the most frustrating aspect of being an investor is that we invariably accumulate knowledge a lot faster than we accumulate wisdom. As such, all of us find ourselves making financial mistakes – sometimes, important financial mistakes – because we have, unconsciously, abandoned rational thinking for emotion and intuition.

A writer of economics, like myself, is privileged by his position to look down upon the mass of investors – analyzing and commenting upon their weaknesses and irrationalities. And yet, when I take the time to examine my own investment patterns, I must admit that, when it comes to buying and selling, I too suffer from many of the same weaknesses and irrationalities I see in others.

The branch of economics that studies such concerns is called “behavioral economics.” In this four-part series, I am going to introduce you to the most practical concepts of behavioral economics. Along the way, I will describe the ubiquitous habits and biases that influence us unconsciously (usually for the worse).

Specifically, we will be discussing what are called heuristics and cognitive biases: powerful patterns of thinking that can lead us astray without our being aware of what is happening. For each of these thinking patterns, I will explain how it affects our decision-making, and what you can do to mitigate its negative effects.

Throughout the series, I will summarize what we have learned and suggest strategies you can follow to rise above your limitations and improve your long-term investing results.

Heuristics and Cognitive Biases: As a general rule, most of us are poor investors. This is because we often make decisions so as to minimize emotional discomfort. As such, we depend too much on our feelings and our intuition when, instead, it would serve us better to cultivate the skills of dispassionate appraisal and rational thinking.

Why should this be the case? The answer has to do with how we think about most things most of the time.

It is the nature of being human that we are called upon to make innumerable judgments, minute after minute, day after day. To do so, we depend on what psychologists call “heuristics”: mental shortcuts that underlie our decision-making processes. Some heuristics are innate, hard-wired into our brain when we are born. Others are based on our experience and are learned as we mature.

We use heuristics many times a day, unconsciously and automatically, whenever we need to solve a problem, understand something, or make a decision. Doing so enables us to make good decisions quickly, often with minimal information.

For example, early one morning you are jogging along a narrow sidewalk and you see someone walking towards you. Without thinking, you move to the right, so the two of you can pass one another uneventfully. This is a heuristic. Later that day, during lunch, someone serves you some fruit, which you notice is covered with a greenish-blue mold and smells funny. You decline to eat it. This, too, is a heuristic. That night, as you are driving home from work, you notice you need gas. You drive to a corner where there are two gas stations. As you approach the corner, you quickly look at the signs and drive into the station with the least expensive gas. You are following a third heuristic.

Heuristics enable us to pass through life smoothly and quickly, from one moment to the next, without having to stop and think deliberately about every action, every judgment, and every decision. Obviously, such quick, automatic actions are helpful, even crucial to our lives and to our well-being. However, heuristics are often imperfect and sometimes irrational. Moreover, because we apply them automatically, it is easy to make poor decisions without being consciously aware of what we are doing.

Along with heuristics, we are influenced a great deal by what psychologists call “cognitive biases”: distorted patterns of irrational thinking that lead to poor judgment. Where heuristics are often useful to our lives, cognitive biases are almost always harmful in some way, as they blind us to the reality of the problem at hand.

The combination of heuristics and cognitive biases is particularly powerful when it comes to thinking about money, especially when we are investing. For example, consider the following question: You own 100 shares of a stock that has gone up a fair bit since you bought it. Lately, however, the price has gone down. How do you decide when it is time to sell?

Knowing when to sell a stock requires you to guess what is going to happen. If you think the value of the stock will go down, you will sell now. If you think the value of the stock will go up, you will wait to sell.

Since you don’t know for sure, however, it is likely that you will fall back on one or more heuristics and cognitive biases to make your decision. Moreover, as you do so, you won’t even be aware of what you are thinking or why.

Much of the investing I do involves selling short-term options based on one particular stock that is especially volatile. This work requires me to watch the stock’s price very carefully, often from minute to minute. As such, I can tell you categorically that stock prices are highly unpredictable. Sometimes they will cruise along quietly for hours, or even a few days, with only minor movement. Every now and then, however, at unpredictable intervals, there will be significant changes within a short time, sometimes within a few seconds.

Nevertheless, it is important to me and the people I work with to anticipate the short-term price changes as best we can. Since no one can predict the future, this often tempts us to make decisions based on an intuitive feeling. If we guess right and we do our job skillfully, we make money. If not, we lose money (and, in the option-selling business, it is possible to lose a lot of money quickly).

Intuitive feelings notwithstanding, when I trade, it is important to me to be as rational and unemotional as possible. This only makes sense: The market itself is unemotional, if not rational.

For this reason, I have spent a lot of time thinking about the heuristics and cognitive biases that color my thinking, so I can eliminate them as much as possible. I would now like to share my thoughts and my advice with you.

False Analogies to the Physical World: The world we live in is, in large part, physical. The stock market, of course, is completely abstract. Thus, when we assume, unconsciously, that the market follows the familiar laws of physics, it leads only to confusion and losses.

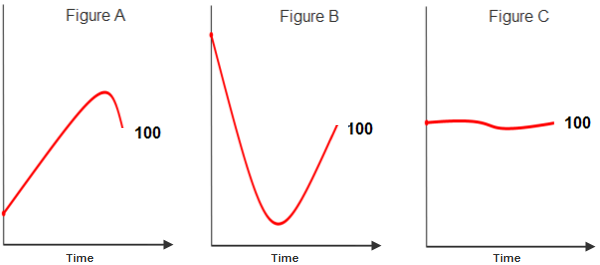

In my experience, one of the biggest mistakes we make is to look at a graph of stock prices and assume that it can help us predict what is about to happen. To see what I mean, I want you to take a look at the three graphs in the figures below and then think about a particular question.

Each of these three curves traces the value of a stock over the same interval of time. Although each stock follows a different path, they all end up with a value of $100/share at the same time. However, the route they follow to get to this price differs considerably. The question I want you to consider is: What will happen next to each of the stocks?

The stock shown in Figure A started with a low value. It climbed quickly, peaked, and then descended to $100. The stock in Figure B started high, fell sharply, and then recovered to climb up to $100. The stock in Figure C started at $100 and stayed pretty much the same the entire time.

If we follow our intuitive heuristics (which work well in the physical world), we will interpret the price curves as being subject to momentum and gravity. Thus, it is easy to conclude that, in the near future, stock A is likely to continue to go lower, stock B will continue to go higher, and stock C will stay about the same. This, however, is not the case.

I have seen these patterns many times, and I can tell you categorically, they indicate nothing about what is going to happen next. Unlike the physical world, the inhabitants of the stock market are not subject to physical laws. Indeed, in the short term, prices have so much randomness that making judgments by looking at graphs and following your intuition is a highly dependable way to lose money.

Harley’s Rule of Investing #1: Your intuition cannot predict what a stock will do.

Representation Bias: In general, one of the best ways to predict what is likely to happen in life is to ask yourself: What happened before under similar circumstances? For example, when we press on the brake, our car slows down; when we press on the accelerator, the car speeds up.

The tendency to assume that similar circumstances will lead to similar outcomes is an important heuristic, one that is particularly useful because many of the details of day-to-day life are highly predictable. Using our past experiences to predict the future enables us to take care of ourselves and to keep ourselves safe.

The prediction heuristic is surprisingly powerful when it comes to understanding other people. For instance, if you want to predict what someone you know will do in a specific situation, all you have to do is remember how they responded in similar situations. For example, let’s say that each time you forget your anniversary, your spouse gets upset and pouts. What do you think will happen if you forget it again?

Because we are human, it is easy to assume that the stock market is influenced by predictable forces, capable of acting in ways that are familiar to us. The market, however, is not at all like the day-to-day world; nor does it experience human emotions or have a personality. When we apply this type of thinking to the stock market, the valuable prediction heuristic quickly leads us astray and becomes a dangerous cognitive bias, which we call “representation bias.”

The truth is, whatever happened in the past to the price of a stock does not indicate what is likely to happen in the future. No matter how strongly the current circumstances seem to resemble patterns we think we remember, the belief that we can use the past to predict the future is nothing more than representation bias, and will almost always let us down with a thud.

Harley’s Rule of Investing #2: When you are investing, the past does not predict the future.

To be continued…