GILTI Tax Hike Could Not Be More Poorly Timed

A Tax on Income Earned Abroad May Go Up

As California continues to rebuild after the greatest crisis of our lifetimes, some Washington politicians are once again demonstrating their disconnect from the realities of our tax system and the impacts of bad policy on American consumers.

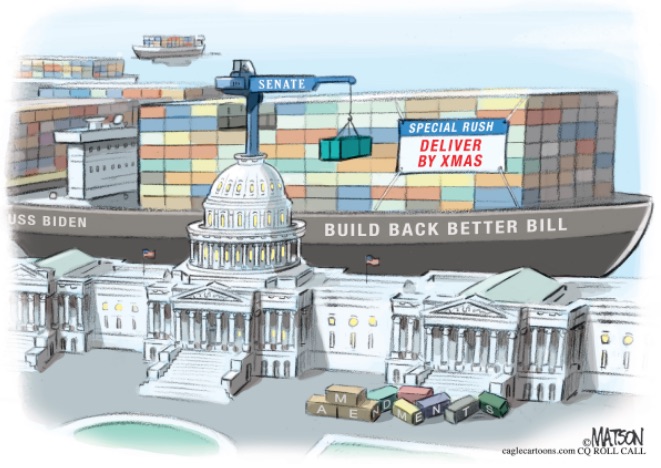

A perfect example is what is currently happening with President Biden’s Build Back Better Act as Washington lawmakers are currently planning to increase the rate of a little-known tax called the Global Intangible Low Tax Income or GILTI.

GILTI is a tax on American multinational corporations intended to discourage companies, largely in the technology sector, from shifting profits on easily moveable items, such as intellectual property, to other countries with lower tax rates.

However, GILTI also impacts other sectors like energy, manufacturing, and critical supply-chain industries. If the proposed increase is enacted, American businesses of all sizes would be adversely impacted — specifically penalizing businesses in states like California which are far more likely to have a foreign presence in their supply chain.

A study from the National Association of Manufacturers illustrates the potential harm which an increase in GILTI could produce. According to the study, the first year of a GILTI increase would cost the United States up to one million jobs and $20 billion in economic activity. This would certainly add to the economic devastation of California, a result of more than 40,000 of our small businesses which closed due to the pandemic in 2020 alone.

Discussions are ongoing between the United States and other countries regarding a separate global minimum tax, which would be levied in addition to GILTI. Why would we raise GILTI before determining the effects this proposed global minimum tax? Why would we proactively levy additional taxes on our own businesses and give countries like China an additional advantage in the global marketplace?

While we agree that investment in infrastructure may be warranted, unnecessarily raising GILTI at the expense of our global competitiveness while setting back our domestic economic recovery is poor policy. The last thing we need now are higher costs for consumers, reduced wages, and fewer jobs.

Rather than increasing tax revenues through exorbitant rates and fees, our lawmakers should consider other solutions to raising funds which do not impact California’s Main Street workers and businesses. One such solution would be to close the tax gap — the amount of uncollected taxes by wealthy multinationals — which could raise up to $7 trillion within the next decade according to best estimates.

Our lawmakers must grasp the potentially severe consequences which raising GILTI could impose on the American economy and arrive at a more equitable and fiscally responsible method of financing the Build Back Better Act.

Tom Widroe is executive director of the Santa Barbara County Taxpayers Association.