An Overview of 2023’s Local Real Estate Market

A Detailed Look at Factors Affecting Buying and Selling

When we look back at 2023 as a whole, home prices on the South Coast held steady for the most part, despite interest rates rising and a general feeling that prices would come down. Lack of homes for sale, which we will talk about more, may have been the driving force for this dynamic. Additionally, there’s a seeming contradiction in the local housing market right now: Prices overall are not dropping when looking at the market as a whole, but home buyers are noticing price reductions on a good number of individual listings. What’s up with that? Let’s take a look at this dynamic and let the statistics help explain it.

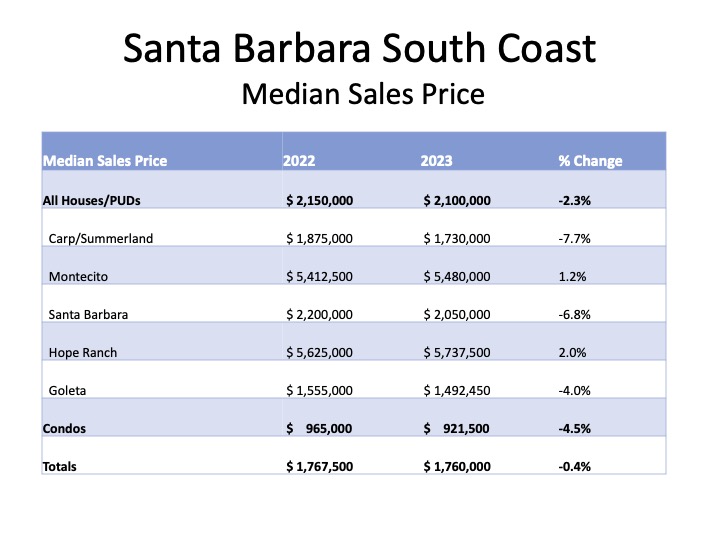

Home prices for houses at the end of 2023 are nearly the same as they were at the end of 2022: Median selling price for the year 2023 was $2,100,000, compared to $2,150,000 in 2022. That’s only a 2.3 percent difference for all homes on the South Coast of Santa Barbara County, which is Goleta through Carpinteria.

We are coming off several years of rapidly increasing sales prices, so it’s understandable that home sellers price their homes correspondingly — higher than the last sale. But this isn’t working anymore. Homes that are overpriced for today’s market are lingering on the market, getting price drop after price drop. Homes that are 10 percent or more overpriced are often being passed over by buyers who are mindful of not overpaying. Astute sellers who price their homes at or just under comparable sales are reaping the benefits of getting a quick sale, sometimes with multiple bidders — and sometimes over asking price! It really does pay to get an up-to-date market analysis on the value of your home: Homes that are priced right sell for more than homes that were overpriced to begin with and need several price reductions to attract buyers.

The median list price of houses in 2023 was $2,100,000 — up 5 percent from $2,000,000 the year before. Because original asking prices were higher overall, many homes needed price reductions to meet sales prices that remained flat. Keep in mind that median price reflects the mix of homes sold as well as price appreciation. More homes selling at the higher end will bring the median up, which we saw in 2020 and 2021. Relatively more homes selling at the lower end will skew that median lower, which we are starting to see now.

In 2022, south Santa Barbara County reached a record low in the number of houses for sale, often referred to as “listings.” That year, there were only 1,011 houses and PUDs for sale all year long. In 2023, there were even fewer houses for sale — only 857 all year. Putting this in perspective, the last 20 years shows an average of about 1,500 houses a year being listed for sale. So, if it seems like there’s nothing for sale, that’s why. The supply of homes in our area is at a new record low.

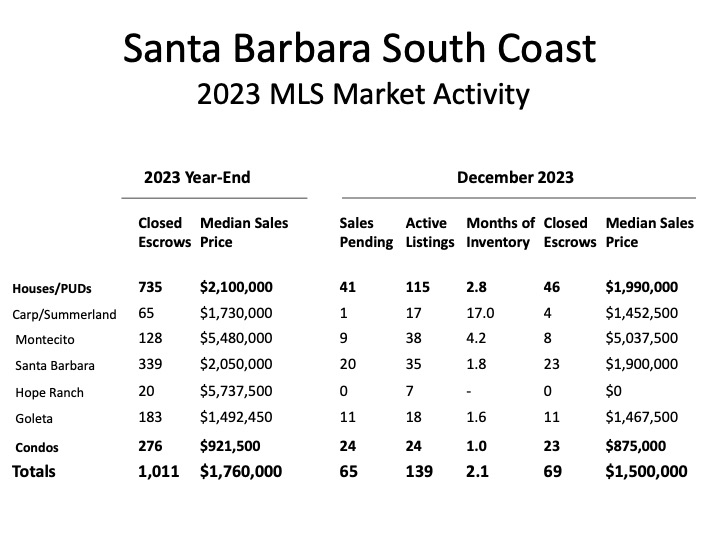

Turning our attention to condos, the story is similar, but the median sales price drop is more than houses, with 4.5 percent decline in selling prices in 2023. It now sits at $921,500 compared to 2022’s $965,000. Condo buyers are more impacted by the increase in mortgage interest rates over the past couple of years, and we are seeing fewer condo sales, too. Total 2023 sales of condos numbered 276 in 2023, down a whopping 25 percent from the year before.

Combining houses and condos, the median sales price for 2023 was $1,760,000. One year earlier, the median sales price was $1,767,500. That’s four-tenths of one percent decline. So, no, prices are not dropping precipitously, and with record low (really low) inventory, it’s still a seller’s market out there in most market segments and probably will be for some time (if the property is priced right!).

Another useful stat that gives a snapshot of what’s happening right now in the market is the “months of inventory” figure. In the above table, you’ll see this number along with median sales prices for each of our market areas. The months-of-inventory figure is calculated by dividing the number of active listings by the number of sales pending. This tells us how many months it would take for all the homes on the market to be purchased if no new homes were listed. Also called market velocity, anything under three months of inventory is considered a strong seller’s market. We’re sitting at 2.1 months at the end of December, and the condo market has just one month of inventory — super low! In other words, there is high buyer demand and properties are still selling quickly.

These numbers tell us a lot, but there’s often more to the story. For example, if you look at the row for Carpinteria/Summerland, it looks like it’s a buyer’s market with 17 months of inventory. More than six months of inventory strongly favors buyers. However, if you dive deeper, you’ll see that most of these listings are expensive homes. It’s a buyer’s market for those looking to spend more than $10 million in Carpinteria, but for other home seekers, sellers still have the upper hand. Since each market area appreciates or depreciates differently — as shown in the second graphic comparing 2022 to 2023 for each of our main market areas — it’s a good idea to get more detailed information from your real estate agent for the neighborhood and price range you’re interested in. Agents are a great source for the stats and stories behind each sale.

Stay tuned to this column next quarter to follow the real estate market in 2024. It’s very busy this month! Happy New Year!

Data for this article was compiled by the Santa Barbara Multiple Listing Service and analyzed by members of the S.B. Association of REALTORS® Statistical Review Committee. Writer Kalia Rork is a Realtor with Berkshire Hathaway HomeServices California Properties, who has been a contributor to this column for 15 years and who is celebrating 23 years in real estate. Contact Kalia at (805) 689-0614 or kalia@liveinsb.com, or see liveinsb.com. DRE lic# 01313668. Broker lic# 1317331.

Premier Events

Sun, Apr 28

6:00 PM

Santa Barbara

AHA! Presents: Sing It Out!

Thu, May 02

5:00 PM

Santa Barbara

Things with Wings at Art & Soul

Sat, May 04

10:00 AM

Lompoc

RocketTown Comic Con 2024

Sat, Apr 27

11:00 AM

Santa Barbara

Santa Barbara Plant Fest

Sat, Apr 27

3:30 PM

Santa Barbara

Santa Barbara Trapeze Co and Unity Shoppe Spring Food Drive

Sat, Apr 27

8:00 PM

Santa Barbara

Beau James Wilding Band Live

Sun, Apr 28

11:00 AM

Santa Barbara

Santa Barbara Earth Day Festival 2024

Wed, May 01

7:30 PM

Santa Barbara

American Theatre Guild Presents “Come From Away”

Thu, May 02

5:00 PM

Santa Barbara

100th Birthday Tribute for James Galanos

Thu, May 02

5:00 PM

Santa Barbara

Meet the Creator of The Caregiver Oracle Deck

Fri, May 03

4:00 PM

Santa Barbara

Santa Barbara Fair+Expo “Double Thrill Double Fun”

Fri, May 03

8:00 PM

Santa barbara

Performance by Marca MP

Sat, May 04

10:00 AM

Solvang

Touch A Truck

Sun, Apr 28 6:00 PM

Santa Barbara

AHA! Presents: Sing It Out!

Thu, May 02 5:00 PM

Santa Barbara

Things with Wings at Art & Soul

Sat, May 04 10:00 AM

Lompoc

RocketTown Comic Con 2024

Sat, Apr 27 11:00 AM

Santa Barbara

Santa Barbara Plant Fest

Sat, Apr 27 3:30 PM

Santa Barbara

Santa Barbara Trapeze Co and Unity Shoppe Spring Food Drive

Sat, Apr 27 8:00 PM

Santa Barbara

Beau James Wilding Band Live

Sun, Apr 28 11:00 AM

Santa Barbara

Santa Barbara Earth Day Festival 2024

Wed, May 01 7:30 PM

Santa Barbara

American Theatre Guild Presents “Come From Away”

Thu, May 02 5:00 PM

Santa Barbara

100th Birthday Tribute for James Galanos

Thu, May 02 5:00 PM

Santa Barbara

Meet the Creator of The Caregiver Oracle Deck

Fri, May 03 4:00 PM

Santa Barbara

Santa Barbara Fair+Expo “Double Thrill Double Fun”

Fri, May 03 8:00 PM

Santa barbara

Performance by Marca MP

Sat, May 04 10:00 AM

Solvang

You must be logged in to post a comment.