A Conversation With American Riviera Bank Founder Michael Salsbury

Money Talks

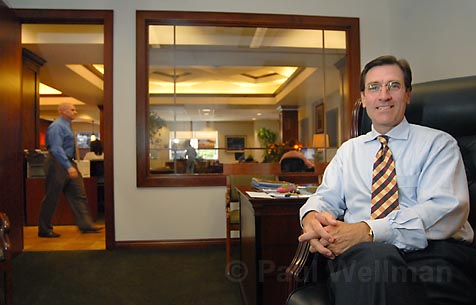

Michael Salsbury founded American Riviera Bank one year ago in July as a completely local bank. All of American Riviera’s boardmembers, stockholders, borrowers, and the enterprises the bank has financed are entirely Santa Barbaran. The 14-member board includes members as diverse as Alixe Mattingly-former deputy press secretary for the first President George Bush-and Joe Campanelli, owner of Campanelli Construction and founder of a coalition pushing for stricter green-building ordinances in Santa Barbara. Salsbury said the variety reminds him of his experience in European banking, in which different nationalities, faiths, and political leanings got along famously. As it approaches its first birthday, the bank has accumulated $50 million in total assets. Martha Sadler chatted with Salsbury-who is also the bank’s CEO and president-in the bank’s feng shui-designed building at the corner of Anacapa and Figueroa streets.

How many banks can Santa Barbara support? People look around and think that Santa Barbara is saturated with banks. They see a bank on every corner, but FDIC [Federal Deposit Insurance Corporation] statistics are telling us Santa Barbara is still 10 branches short. Believe it or not, in our little town of just 90,000 people, there is more than $4 billion in non-interest bearing checking accounts, excluding money markets and CDs.

How have you been able to compete with the more established banks? If you look at the local banking landscape, there have been major changes in just about every bank in town. We had leadership changes at our two legendary community banks, Santa Barbara Bank & Trust and Montecito Bank & Trust. We had Rabobank acquiring Mid-State; we had Merrill Lynch acquire First Republic. And then it was announced just a couple of months ago that Heritage Oaks Bank from Paso Robles had acquired Business First Bank.

So here we are suddenly with probably the most stable, cohesive executive management team and board of any bank in town, even though we are a humble year-old bank. Our management team is all local, and we all bonded quite well during two and a half years of decision-making that led up to the bank’s opening. I think that’s partly why morale is so good. Besides, we have 400 local ambassadors-our shareholders-who are out there talking about us.

What do you offer that’s different from other banks? We really believe that many local banking clients have become accustomed to a mediocrity in their banking. Our view is that people should view their banker as they view their CPA, attorney, or physician. Your banker used to be your trusted advisor, and our aim is not only to say that but deliver it. We see our small size as a strength; we kind of view ourselves as the agile little speedboat and these guys are the Exxon Valdezes of the world : The only thing worse than a fast no is a slow no. If you drag somebody out for a month only to tell them no, they harbor that resentment for a long time.

How do ethics come into the bank’s decision-making processes? For example, some banks won’t make loans to companies with bad records on human rights. You’re not an international bank, but Santa Barbara has its own issues. Instead of saying what we would not do, I would turn it the other way and say that what is important to the Santa Barbara community is important to us. We discount on the lending fees that we charge on green building projects, for example. Joe Campanelli refurbished this building with a lot of green elements; Joe knows all the details about what bulbs use how many barrels of oil each year. So we’re supportive of that.

Do you think you could finance affordable housing in Santa Barbara? Well, I think that whether it’s affordable housing or financing a spec home in Montecito, Santa Barbara is an area where there’s a lot of competition for loans, and there are a finite number of lending opportunities too, because of the small size of the town.

What about loans to entrepreneurs without any track record? It comes back to the people, their business plan, their chances of succeeding, their ability to repay the loans-all of that goes into loan underwriting and analysis. Again, whether it is an entrepreneur or whether it is a business or a wealthy individual or a community reinvestment loan, we really and truly try to be supportive. You see our offices [which are highly visible with large windows]? This is not chance. When we were designing the bank, it was very important to me that people coming into the bank have access to decision-makers. I want them to be able to see the whites of our eyes. I don’t want them to feel like we’re up on the fifth floor and hidden somewhere.

Can you just open a simple checking account? Well, yeah, we have all of that, and we don’t charge a penny for it. We don’t charge for ATM or for “piss-off fees,” as we like to say. If you use our card in any ATM machine in the world, we rebate the fees. They’ll charge the $2.50 but we’ll track it and then at the end of the month you’ll get a credit back on your statement.

Gee, maybe I should switch from Bank of America. I don’t usually comment on-well, first of all, the other community banks, Santa Barbara Bank & Trust, and Montecito Bank & Trust have been pillars of this community for many years, and they give us a lot to aspire to. At the same time, we have given them a reason to up their game. But I will say that the Bank of Americas and the Wells Fargos of the world are the best thing that could ever happen to community banks.

By contrast, you mean? I just mean that banks get so large and they become so institutionalized and so formula-driven-it plays precisely to our strength.