A Look at First Quarter 2023’s Unique Local Real Estate Market

Real Estate Housing Statistics are Making National Headlines Again

Real estate housing statistics are making national headlines again with the National Association of Realtors® (NAR) reporting home prices are down slightly and the number of home sales are down significantly across the nation. We like to think we’re unique here in Santa Barbara. Indeed, our South County real estate market differs from the U.S. in some ways and can also follow the national trends. Here’s a recap and analysis of the real estate market’s first quarter 2023 for the areas between Goleta and Carpinteria.

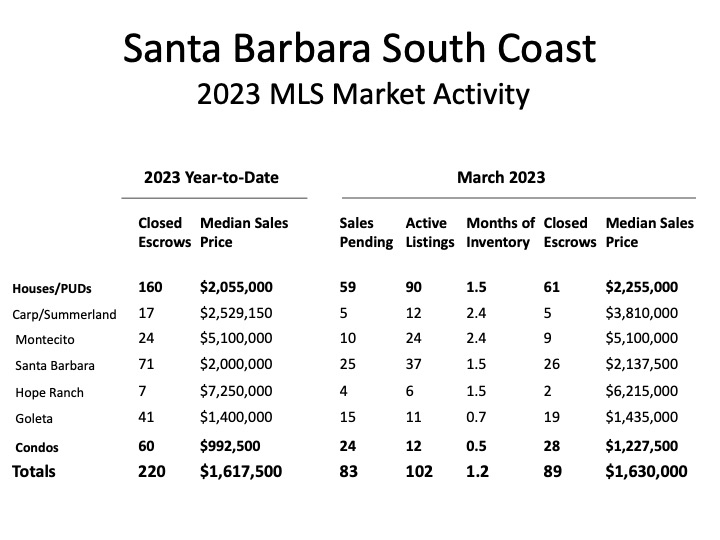

How many homes are selling? NAR reports existing home sales declined a whopping 22 percent nationwide from a year ago for condos and houses combined. Santa Barbara has that beat. Sales are down almost 40 percent from the 12 months prior. Keep in mind that from mid-2020 to mid-2022 (the pandemic surge), sales here were very robust and among the highest we’d seen in a decade and a half, so some of the difference between this year and last is because those pandemic years were a frenzy for home sales. In the first three months of this year, only 220 homes closed escrow (half of what we saw in the first quarter of 2021); however, that is partially due to January and February 2023 being particularly sluggish for sales. March was busier with 89 sales, and April is keeping a similar pace, so we expect our number of home sales to continue to increase. Although higher prices and interest rates are deterring some buyers, one important factor in this low number of sales is that there just isn’t much to buy. The number of homes for sale, called “inventory,” is still very low.

Are properties still selling quickly? In 2021, an amazing 97 percent of listed houses sold (smashing the record of 88 percent set the year before), and in 2022, 93 percent of houses that came on the market closed escrow. The months-of-inventory (MOI) figure you see in the chart is a calculation showing how long it would take for all the listed homes to sell at the current rate of sales, if no new homes came on the market. Right now, that is 1.2 months for all properties. It’s just 15 days (0.5 months) for condos! An MOI under three months is considered a strong advantage to sellers (a sellers’ market). Still, it’s a little easier for buyers now because last year at this time, houses were selling even faster: There were only 18 days of inventory across the board and just three days for condos! If you were hunting for a condo last spring, within three days, all the condos on the market would be gobbled up by new buyers. Now it’s 15 days. Slightly easier, but still tough, for condo buyers — and still very propitious for condo sellers. Nationally, there are 2.9 months of inventory of houses and condos, up slightly from the national average a year ago.

You’ll also see in the chart that there were just 12 condos for sale in all of the South Coast — Goleta to Carpinteria — in all price ranges at the end of March. Condos typically reflect the entry-level market, and that is where a high percentage of active buyers are now. Houses and condos that are priced right are still getting multiple offers, especially in price ranges up to about $1.5 million.

Homes still have multiple bids. Are prices really dropping? Nationwide home prices declined about one percent from this time one year ago. Locally, the median price for houses sold in the first quarter of last year was $2,251,000. Now we’re almost $200,000 less than that — $2,055,000 — which is an 8.7 percent drop. However, the median price for just March this year, $2,255,000, is almost the same as last year, when the market was near its peak. (April 2022 was the top of the market for houses, showing a median sales price for that month of $2.5 million.) It’s super important to remember that in small markets like ours, the median price fluctuates more on a monthly basis because a few low or high sales can pull this number one way or the other. As the year progresses and there is more data, this balances out.

For condos, it’s a whole different ride. Take a look at the median sold price of condos in the chart. At $992,500 year to date, that’s a record high and up 10 percent from last year’s median at this time. Condo prices increased steadily all year last year and are up 2.8 percent from December. This is the more affordable end of the market, and such low inventory is putting upward pressure on prices. At the time of this writing in late April, we’re seeing more inventory come on the market. For example, there are now 20 condos for sale in the south county, and 14 of those are less than $1.5 million.

What’s next? Low interest rates in 2021 and part of 2022 prompted many homeowners to refinance into a mortgage with an interest rate of around 3 percent. The rate is double that now, adding approximately $1,600/month to a $900,000 mortgage. People who must sell (a bigger house, smaller house, different location, different school, death in the family, etc.) are still going to sell no matter what the mortgage rates are doing. The folks who are moving just for a change, but don’t have to, are more hesitant if they’re sitting with a 2.99 percent rate on their current home. It is quite possible that this group of hesitant sellers could keep inventory low here for at least a few more years, or until interest rates drop.

The chief economist at NAR, Lawrence Yun, predicted 2023 would see the number of sales decline by 7 percent overall with home prices claiming only a one percent rise across the nation. Locally, our real estate market will probably continue to be slower than the national average, but if we had to make a wager, we’d bet prices at the end of 2023 land pretty darn close to where they were last year, just like the national prediction. However, this can vary even at the neighborhood level. To find out more about a particular market segment, reach out to your Realtor. And come back to this column next quarter to see how the spring and early summer market took shape.

Data for this article was compiled for January through March 2023 by the Santa Barbara Multiple Listing Service and analyzed by members of the S.B. Assoc. of Realtors® Statistical Review Committee. Writer Kalia Rork is a Realtor with Berkshire Hathaway HomeServices California Properties, who has been a contributor to this column for 14 years and who is celebrating 22 years in real estate. Contact Kalia at (805) 689-0614, kalia@liveinsb.com, or liveinsb.com. DRE lic# 01313668. Broker lic# 1317331.

You must be logged in to post a comment.