A Fair American Flat Tax

Tax Reform Is Equitable for Everyone

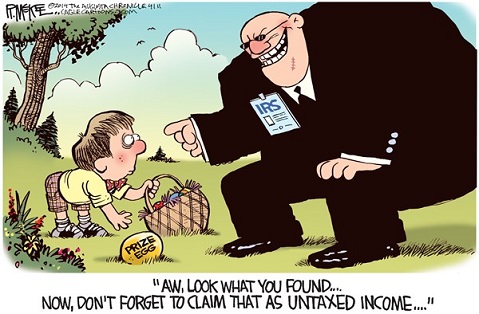

The United States and the states must reform their tax structures to make it more equitable for everyone.

Today 40 percent of the people pay 90 percent of the taxes. In addition, everyone wants to be excluded from paying any taxes by gaining special exemptions at the expense of other taxpayers. This is social redistribution of wealth: Un-American and unfair.

The easiest way to redo the tax system is by making the 16th Amendment to the Constitution in 1913, the income tax, a flat tax of not more than 1.5 percent of a person’s gross yearly income. If you made $10,000 a year, you would pay $150 a year, and that is all. No tax return to prepare and no taxing of your savings. No other taxes except FICA to pay for Social Security and Medicare, if they still exist by then.

And, if you earned a gross income of $100,000 a year, you would pay an income tax of $1,500 per year. This tax would be taken out of your paycheck directly as FICA and income tax presently are.

There would be no other deductions, tax credits, or write-offs, and no tax reporting. This would end the present outlandish tax code.

Your savings, Social Security, and stock profits would be yours, and your stock losses would be yours, too.

Companies would report their gross incomes through a CPA and submit a check for 1.5 percent of gross: no write-offs, no depreciations, etc.

All nonprofits would pay, meaning all religious organizations, the Sierra Club, the Farm Bureau, ACORN, AARP, Democrat Clubs, Republican Clubs, unions, etc. would hand over 1.5 percent of their gross incomes! No exceptions, no excuses, no exemptions.

Taxes could not be raised except by a supermajority in Congress, but only every four years, if that, and for only 0.1 percent at a time, if approved, with 5 percent the max.

If this is not enough to run the government, then cut the government to fit the taxes. But, when everyone pays their fair share, there will be plenty of revenue.

Flat taxes being considered by other groups of 15, 17, and 30 percent are just too high and do not solve the American tax problem with their deductions and tax credits.

A small fair tax for everyone is the solution! This is real tax reform.