Propping Up Education

Officials Expect Cuts and Cutbacks if Tax Initiative Fails

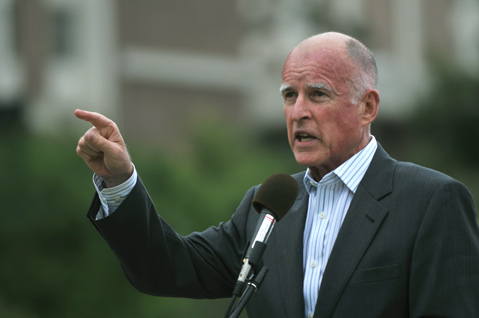

If Governor Jerry Brown’s tax proposal on November’s ballot fails, it will take about eight weeks before the dust settles and the cuts come down from on high. But come down they will.

And like many cuts these days, they will hit in areas that hurt the most — like, in this case predominantly, education. If Proposition 30 is rejected by the voters, the state’s main operating budget — which was approved in June — will have to be cut by an estimated $6 billion this year alone, with the majority of it hitting our schools.

The tax will only hit the state’s wealthy while paying down California’s debt, proponents say. Opponents of the proposition, which include the Howard Jarvis Taxpayers Association and the National Federation of Independent Business California, say the proposition is a small-business killer, a tax raise with no reform, and a tax raise that politicians can spend as they please.

Proposition 30 will increase the sales-tax rate by one-quarter of a cent from 2013 through 2016. Personal income tax on the wealthy, who currently pay 9.3 percent, would also be increased — an additional one-percent marginal tax rate on individuals who make between $500,000 and $600,000 a year, an additional 2 percent for those between $600,000 and $1 million, and an additional 3 percent on those whose income is in excess of $1 million. These increases would run from the 2012 tax year through the 2018 tax year.

The increases, according to the nonpartisan Legislative Analyst’s Office, would impact about one percent of the state’s income-tax filers, who currently contribute about 40 percent of state personal income taxes.

The Legislative Analyst’s Office anticipates the measure bringing in $6.8 billion, while Brown has said it could bring in as much as $9 billion. “That’s a big spread,” said Meg Jetté, the finance guru for the Santa Barbara School District. “What if it’s not $9 billion, it’s $6.8 billion? It wouldn’t cover everything.”

To make matters more uncertain, there is a competing tax measure on the ballot that would raise personal income tax rates on most taxpayers in the state for 12 years. It would raise an estimated $10 billion next year and would be allocated for education and the state’s bond debt. But the way the money can be used is much more limited, and the money is outside the state budget process. Proposition 38 is not polling as well as Brown’s measure.

A poll conducted in early August by USC showed support for the governor’s proposition at 55 percent. However, that same poll showed public concern over how government was spending and supervising the money it already receives from taxes. For example, here in Santa Barbara County, three public employees have been arrested for allegedly misappropriating public funds for personal use.

Brown has been working at the state level to cut costs and eliminate waste while, here in Santa Barbara, officials have spent the last several years slashing away at their budgets and are already operating at levels lower than have been seen in years. The county has instituted some pension reform measures, and there are fewer staff members and no raises.

Here’s a rundown of what local officials anticipate will be the impact if Gov. Brown’s Prop. 30 fails to pass in November.

UCSB

Last month, UCSB Vice Chancellor Gene Lucas predicted the school could face cuts near $40 million if Prop. 30 fails. The university’s budget has already been cut by $155 million over the last two years, he said.

The UC Board of Regents has endorsed Prop. 30, saying that “the ability of the University of California to ensure the high-quality education that Californians have come to expect will be jeopardized if the state is unable to adequately fund UC’s core mission.” Estimates are that it would lose $375 million.

The UC system is now funded at 1997 levels, despite the fact it has 75,000 more students enrolled than it did that year. If Prop. 30 does not pass, Lucas said, UC Regents must consider a 20-percent tuition increase.

S.B. City College

“It’s such an important initiative for higher education,” Lori Gaskin, SBCC president, explained over the phone last week. “Our state, to me, was founded on an elegant and brilliant principle — that everyone who has a desire for higher education can achieve that.”

Community colleges in California are looking at a $338-million hit if Prop. 30 doesn’t pass, on top of $800 million in cuts over the last few years.

This year, Gaskin can’t plan for anything at SBCC — named just last week as one of the top community colleges in the nation — until she knows the fate of Prop. 30. If it doesn’t pass, she’ll have to institute another $4.6 million in cuts, or the removal of 200 course sections. She avoided doing it for the fall semester, which means if Prop. 30 fails to pass, Gaskin will have to institute major cut in the spring session. “It’s a tragedy waiting to happen for our students,” she said.

Santa Barbara School District

The Santa Barbara School District, in recent years, has trimmed more than $20 million from its budget. This year, the district has budgeted for the worst and already instituted

seven furlough days for the year, just in case Prop. 30 doesn’t pass. “We can’t get caught with our pants down,” Assistant Superintendent Jetté said.

As part of those furloughs, the district reduced the school year by five days this year, and under state law, it can reduce the year by 15 days total over a two-year period. So, if it must, it can take away another 10 days next year.

Should Prop. 30 pass, district officials would like to reinstate those five days of teaching, plus two days of teacher work days (this would have to be negotiated with the teachers union).

The annual cuts have already been devastating. Maintenance has almost ground to a halt. Kindergarten through 3rd grade and high school classes are seeing their biggest class sizes ever. “We’ve cut every possible area we could where we thought there was fluff,” Jetté said. “We’ve pulled every trick out of the hat; now all we have is people.”

Santa Barbara County

While the majority of the cuts would come in education, there are other impacts, as well, according to Assistant County CEO Terri Maus-Nisich, who monitors what is happening at the state level for the county. Courts would see cuts of $125 million — the equivalent of three days of closure per month — while CalFire would have $15 million (about 10 percent of its budget) sliced. State parks reductions would eliminate beach lifeguards and reduce the number of park rangers and game wardens. “It is very important for local governments to remain vigilant,” Maus-Nisich said in an email. “Should other shortfalls in revenues occur beyond what the state [has projected], it may again be necessary to look back to local governments.”