‘Mythical Being’ Wants Naples

Chinese-American Investor David Liu Eying Prized Gaviota Property

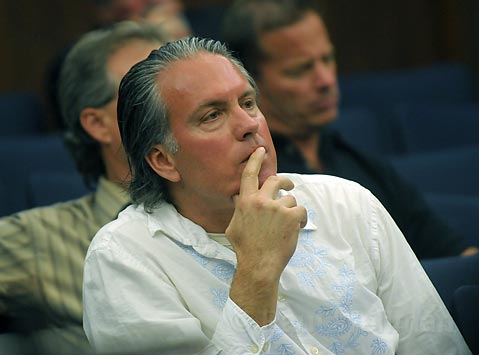

The long-dormant fight to carve 1,000 acres of breathtaking Gaviota real estate along both sides of Highway 101 into 72 parcels — a k a the Naples Project — just woke up. Matt Osgood, whose bankruptcy in 2010 put the development of Santa Barbara Ranch into a state of suspended agitation, is back, hoping to revive his old project with a new ownership structure. Osgood and his brother Mark, a real estate investor, enticed Chinese-American investor David Liu of Arcadia to buy the Naples property for $44.5 million.

Liu presides over Standard Portfolios Asset Management, which formed in 2009 and was reported to have soon invested about $480 million in 8,000 rental units and condos in Texas, Florida, Maryland, and Arizona. Mark Osgood reportedly was an agent in the Arizona deals. Liu, who owns a company that manufactures and sells patio furniture, made his fortune in Chinese real estate, Osgood told the Wall Street Journal; Liu’s entry into Santa Barbara’s real estate market marks the first major infusion of Chinese investment capital on the South Coast. On paper, such dramatic transactions should dazzle county land-use planners, but county planning chieftains are anything but sold. And based on the agreement Osgood negotiated with the county, the county’s director of Planning and Development (P&D) must consent to the property transfer.

Since Osgood went belly-up in 2010, two other entities have sought the county’s approval to transfer ownership from First Bank, which held the paper on Osgood. Both appeared sufficiently endowed with financing and reputation to carry the controversial development to fruition. But on closer examination, both flamed out in spectacular fashion; one of the would-be buyers had a string of 30-40 bankruptcies to his name.

With this history in mind, Glenn Russell, the county’s director of P&D, has been more than a little skeptical when it comes to green-lighting any new owner’s resources and reputation, the two criteria by which a denial of consent can be legally justified. Russell expressed chagrin at how little information Standard Portfolios provided. “There was nothing,” he said of the application. “There was nothing about how much money they had, and there was nothing about their reputation, so there was nothing for me to go on.” Last December, Russell rejected Standard Portfolios out of hand. Since then, there have been lots of questions but not many answers. Although Matt Osgood and his attorney have met with Dianne Black, assistant director of P&D, to discuss plans for bringing the Naples project out of mothballs, no one at the county has laid eyes on Liu, let alone met him. “He’s just a mythical being,” Russell commented.

As for Matt Osgood and his role in the development, the picture is hazy. Is he an owner, partner, or consultant hired by Liu? “I’m not privy to disclose that,” he said, adding, “I’m involved with developing the vision and executing the plan.” While those in the land-use universe contend there’s no such thing as “bankruptcy virgin” among real estate developers, Osgood’s financial crash — in which he left his bank holding a $63 million note and other investors sizable amounts — could come back to haunt him. Some opponents in the environmental camp have suggested his financial demise should give Russell pause when it comes to assessing the “reputation” of the new developers. But if so, Russell isn’t saying. “The word that comes to mind about Osgood,” he said, “is tenacious. Tenacious.”

To move the project forward, he’ll need to be. When Naples started, it was about 450 acres. Now it’s about 1,000. For environmentalists concerned about the Gaviota Coast, Naples qualifies as the proverbial line in the sand. Multiple county approvals — each one involving a balancing act of land-use policy making — are required. Each one entails a battle royale before the Planning Commission and then the County Board of Supervisors. The California Coastal Commission has to sign off on anything that happens on the ocean side of the proposed project. It also has to give its blessings to major infrastructure improvements with coastal endpoints, essential to the 50 approved lots on the inland side. To date, the Coastal Commission has looked seriously askance at these.

Some have speculated the arrival of Chinese investment capital could give Osgood serious staying power against environmental opposition. Whether such conjecture qualifies as smoke or fire has yet to be determined. In the meantime, Liu and Osgood have appealed Russell’s denial to the Board of Supervisors. When that is depends on when they provide answers to Russell’s questions. In the meantime, Osgood said, he’ll be assembling that information.