City of Santa Barbara Facing $1.1M Budget Deficit in 2024

Revenues Aren’t Growing as Fast as Expenses; City Expects Deficit to Grow to $4.8 Million By 2025

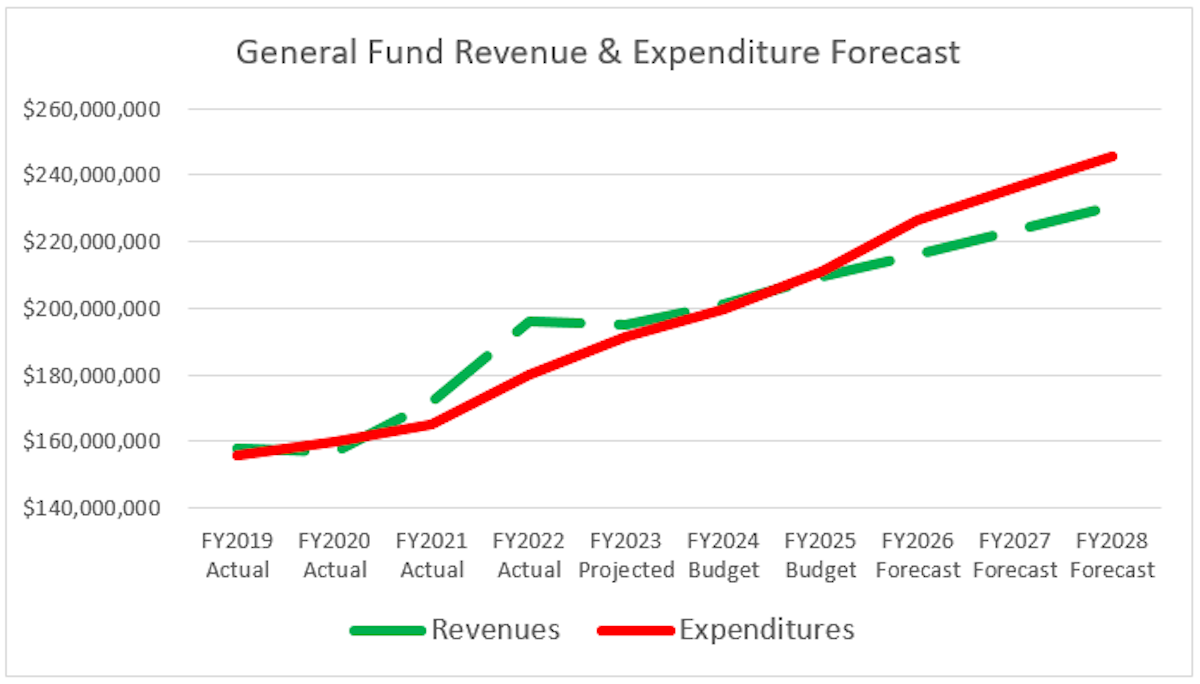

It’s budget season, and the city of Santa Barbara is looking for ways to tighten up its $667 million operating budget as the city prepares for a possible recession and for a general fund deficit that is expected to grow from just over $1 million next year to $4.8 million in 2025.

As with the county’s recently released Fiscal Year 2023-2024 Budget, the city of Santa Barbara’s operating budget continues to grow along with its revenues, but while the county was able to balance its budget without falling into the red, the city is having a tougher time making ends meet as incoming revenues aren’t growing as quickly as the rising costs across the board.

Finance Director Keith DeMartini outlined the most recent budget before the city council — the third in what will be a rapid-fire succession of 17 city-scheduled presentations, hearings, and public workshops over the next month and a half.

DeMartini described the “number of fiscal and budgetary challenges” leading to the projected deficit. After a few years of steady growth, he said, sales tax ($29.4 million) and transient occupancy tax ($26.7 million) are slowing down, along with cannabis tax, which is projected to drop from $1.9 million annually to $1.5 million in 2024 and 2025. The largest general fund tax revenue sources are Measure C sales tax — which is projected to bring in $31.5 million in 2023 — and property tax, which is expected to account for $44.5 million.

“Our property tax continues to be stable and continues to grow,” DeMartini said,” however, our ongoing revenue growth is not enough to cover our ongoing expenditure growth as it relates to salary increases, pension costs, impacts of inflation, and our capital investment required to maintain our infrastructure.”

Had the city not trimmed about $2.7 million worth in budget reductions, he added, the expected deficit for next year could have been much worse than $1.1 million.

“That deficit would have been $3.8 million in 2024,” DeMartini said.

Salaries and employee benefits make up the majority of the city’s general fund spending, with nearly $130 million, or 64 percent, expected to be spent in 2024. Over the next few years, DeMartini said, these costs will continue to rise alongside pension and unpaid liability.

The city takes in the highest proportion of its money through enterprise funds, which represent income generated through the airport, water, waste, downtown parking, waterfront and clean energy programs. These funds are projected to account for more than $289 million, or 43 percent of citywide revenue, in 2023.

Starting this week on Wednesday, the city will host public workshops with budget presentations for each department, along with several more stops at the city council and finance committee before the budget is officially adopted on June 13. Full details for the 2024 budget, including online tools that allow the public to look into specific changes over year to year, are available on the city’s website.